Peloton Interactive Strategy - Part 2

A relook at my Peloton strategy recommendations after considering feedback of "Why are these the strategies that will be most effective in catalyzing, or removing blockers for, growth?"

In October I wrote about how Peloton might consider focusing its strategy around three bold bets. The first recommended that Peloton should offer a wearable device. The second suggested that Peloton could work with health insurers to subsidize a membership to incentivize exercise. Lastly, the third recommended that Peloton have its retail stores double as community hubs.

While the ideas are interesting for Peloton, the biggest piece of criticism has been:

Why are these the strategies that will be most effective in catalyzing, or removing blockers for, growth?

It is a fair criticism.

I was only focused on making Peloton’s ecosystem more robust, independent of any context of what Peloton’s business priorities call for. I need a better structure to compare and contrast opportunities given Peloton’s business priorities.

The reason I write is to learn and so I want to take the opportunity to improve my thinking. Accordingly, I wanted to write about how to think about what Peloton should be focused on today. The first step to accomplish this is providing more structure to easily point to different strategy levers to pull on as different business contexts call for them. This is the focus of this article.

Peloton’s Priority

To date, Peloton has been phenomenal at growing its subscriber base, with 100% Y/Y revenue growth 6 years running and management guiding a 7th, and keeping its customers happy with a crazy 94 NPS for North America Bike owners.

As I discussed in Part 1, what makes Peloton successful is not just any one product, but rather a robust ecosystem.

Given this context, Peloton has been able to establish a sizeable leadership position in the connected fitness space. However, growth must remain a priority for Peloton for three reasons:

Economies of Scale - Scale helps Peloton generate operating leverage by spreading content creation costs over a large user base, improving subscriber economics.

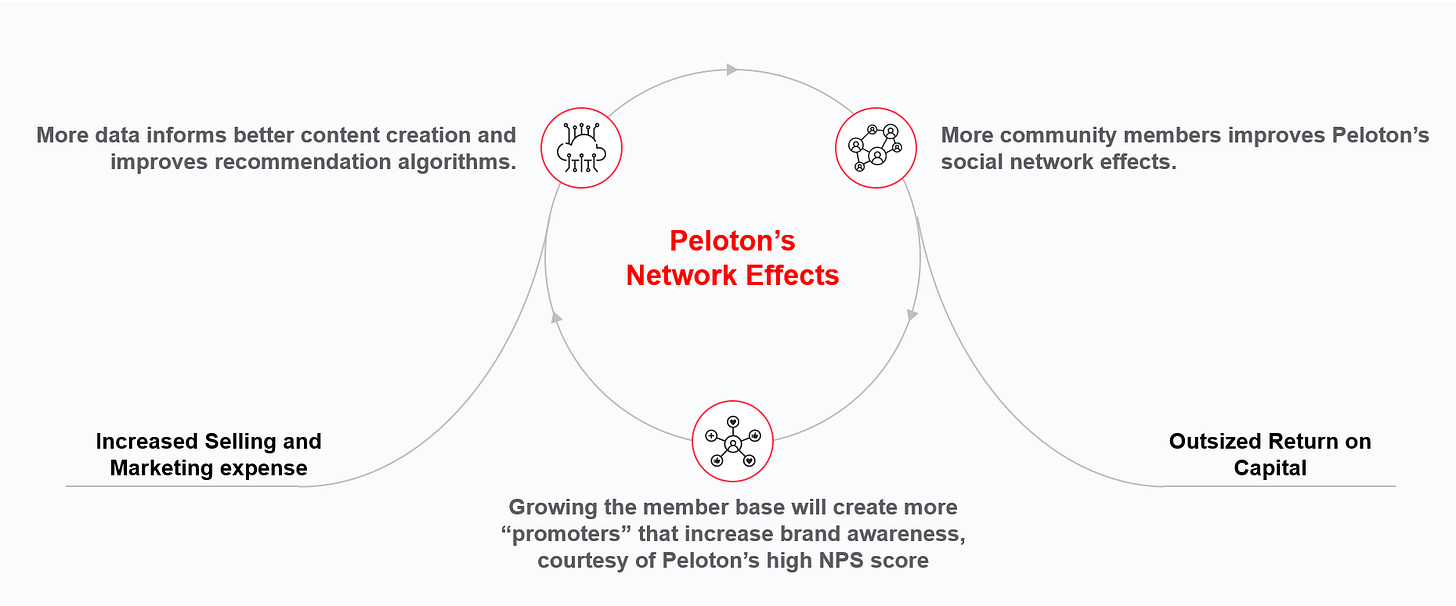

Network Effects - Peloton’s network effects will improve its value proposition in areas like content production/curation from more data and social networks that competitors cannot replicate due to the increasing relative scale.

Remaining Market Opportunity - Peloton has captured just 2% of its TAM and 9% of its SAM, leaving most of the market still up for grabs.

The quicker Peloton captures the remaining market opportunity and increases its relative scale, competitors will be increasingly disincentivized to make investments that would erode value for Peloton.

Thus, Peloton’s priority must be maximizing connected fitness subscriber growth. To accomplish this, there are five steps:

Structure - Identify growth categories and associated growth levers.

Ideate - Propose different opportunities to grow the CF subscriber base.

Prioritize - Evaluate and score the opportunities against each other.

Roadmap - Sequence and timeline the prioritized opportunities.

Plan, Build, and Scale - Create the “unmade future” and turn ideas into reality.

In this piece, we will cover steps 1-4. We will leave Step #5 for Peloton! :)

1. Structure

To begin thinking about growing the subscriber base, we can establish “growth categories” to operate within to increase subscriber count:

Total Addressable Market (TAM) - Households with broadband internet that own or are open to purchasing subscription fitness.

Serviceable Addressable Market (SAM) - Households that are interested in purchasing one or more current Peloton products at the current price.

Market Penetration - Proportion of subscriber base to market size.

To use an analogy, if your goal is to collect as much water as possible, you can benefit from:

sourcing the water from multiple oceans instead of a single pool (TAM expansion),

using a larger bucket (SAM expansion), and

scooping water out more frequently (market penetration increase).

Within each of these growth categories, there are specific levers that Peloton can pull on for growth.

With the growth categories and levers identified, we can now move onto ideation.

2. Ideation

With a foundational structure for understanding how Peloton can achieve connected fitness subscriber growth, it is time to ideate on how Peloton can tactically act on the specific levers.

Instead of going through each idea here, below is a summary, with deep dives on the opportunities at the bottom of this article. Feel free to browse through the opportunities as you wish!

3. Prioritization

The challenge now is that with all of these interesting ideas that Peloton can pursue, where does Peloton start? Going after all of them right out of the gate is, with certainty, a recipe for disaster. Thus, we need to develop a framework to evaluate each opportunity against each other.

Ultimately, the most important considerations for an opportunity are:

What kind of impact can this opportunity make?

How difficult would it be to implement the opportunity?

To provide a little more clarity around the questions, we can break it down further and develop a scoring framework on top of it:

What kind of impact can this opportunity make? (65% of total score)

What is the strategic importance of this opportunity? (40% of impact score)

How much business value does this provide? (60% of impact score)

How feasible would it be to implement the opportunity? (35% of total score)

How complex would it be to implement the opportunity? (40% of feasibility score)

What is the cost of implementing the opportunity? (60% of feasibility score)

Note that they are not equally weighted because impact, business value, and cost are slightly more important than their respective counterparts.

Rolling up our opportunity scores results in the following.

The scoring can now serve a key role in thinking about what opportunities are pursued and when.

4. Roadmap

With opportunities prioritized, Peloton can roadmap the opportunities to stagger resource allocation. When road mapping, it is important to consider:

The Impact - High impact opportunities should come first.

The Feasibility - Overlap of resource-intense opportunities (i.e., considering time, energy, and money) should be minimized.

The Responsible Parties - The responsible business functions should not be overwhelmed with multiple projects.

Furthermore, for low scoring opportunities, it may be optimal to exclude it from the roadmap altogether and periodically reevaluate the opportunity’s fit.

With these considerations in mind, here is a potential roadmap that Peloton can implement over the next few years.

These opportunities will keep Peloton busy with projects through FY2024 and beyond, keeping them on a high growth trajectory. This will help Peloton increase its relative scale to ward off any competitive threats, after which the company can set its sights on what may come next.

Closing Thoughts

Peloton has a tremendous opportunity as the trailblazer in the connected fitness space. Hopefully, part two tacks on a few more interesting ideas and provides a little more structure to think about the opportunities and what levers they pull on.

I believe this roadmap balances seizing the growth opportunities that Peloton has in front of it while prioritizing them to avoid spreading too thin. By my estimates, this disciplined approach has the potential to bring in 6M CF subscribers above and beyond business as usual by the end of FY2026.

To conclude, a few key takeaways:

Peloton’s priority should be growth to take advantage of and improve its leadership position and the scale economies and network effects that come with it.

To grow, Peloton can pull on the different levers associated with TAM expansion, SAM expansion, and increased market penetration.

The most promising opportunities are ones that provide the market with more and better access to Peloton and double down on Peloton’s core principle that connected fitness hardware improves fitness, health, and wellness experiences.

While there are many exciting opportunities, Peloton must be patient enough to roadmap the opportunities to avoid spreading too thin.

Peloton should view this as a starting point and be nimble enough to alter the strategy and roadmap as business priorities and competitive landscapes evolve.

Everything here merely sets the stage for potential value creation - without exceptional execution, these opportunities will not yield meaningful results.

Ultimately, Peloton wins by sticking to its core values and being patient as it expands its reach.

Below, you can find a deep dive on each opportunity — feel free to browse through the ones that are most interesting to you.

If you have any questions, thoughts, or would like to connect, please don’t hesitate to reach out via LinkedIn or Twitter!

Opportunity Deep Dives

Note:

I scored each initiative independently for strategic importance, business value, complexity, and cost based on how well they answered the questions in the scoring framework discussed earlier.

Scores range from 1-5 and a 5 represents high strategic importance, high business value, low complexity, and low cost for the categories.

1. Producing Spanish content

Growth Category: TAM Expansion // Growth Lever: Market Expansion

Strategic Importance: 4 • Business Value: 4 // Complexity: 3 • Cost: 4

Peloton launching in Canada, the UK, and Germany proposes exciting opportunities to grow its TAM. However, it must be careful in approaching expansion because Peloton offers much more than fitness experiences - it also offers community and even ritual, spirituality, reflection, and lifestyle. It is not only scaling a fitness platform but is also attempting to scale its culture across many different cultures.

In this regard, Peloton can take a lesson from Danny Meyer, CEO of Union Square Hospitality Group, in how he approached scaling Shake Shack.

“You better go into a community, whether it's in the United States or abroad, number one with humility, because no one in the world wants you to come in saying, "We're the big, smart, New York people. Lay down for us and eat our hamburgers." That's just not how the world works at all. So you go in with humility and you learn as much as you possibly can about the community”

-Danny Meyer, CEO of Union Square Hospitality Group

Similarly, for Peloton, the last thing that the rest of the world wants is Americans telling them how to think about fitness, health, and wellness and the community, spirituality, lifestyle, and culture that come with it. Because of this, Peloton should:

Invest the time to build trust and integrate into the culture instead of pursuing rapid, mass-scale expansion.

Be thoughtful in international expansion because entering a new market can take a lot of time, energy, and resources to do successfully.

Peloton needs to identify expansion opportunities where the investment is right-sized for the opportunity. To understand where the best opportunities are, Peloton should test markets by expanding its Digital language offerings. This de-risks international expansion significantly for Peloton as it allows them to gauge a market’s receptiveness without the upfront costs that come with establishing a physical presence (retail stores, warehouses, delivery vans, service capabilities, etc.).

Peloton can start testing expansion with Spanish. Within the United States alone, there are 8.7M spanish-speaking households making over $50K, representing an ~9% increase to Peloton’s target demographic. Because this is a core market, it requires minimal additional investments beyond content, providing a tremendous opportunity.

Beyond the United States, Peloton also has to opportunity to expand internationally in Mexico and Spain.

Mexico has a $2.1B health club market and Peloton could leverage the New York studio and its North American distribution infrastructure to carve out opportunity.

Spain is the fourth largest fitness market in the EU at €2.5B in annual fitness revenue. If the market is receptive, Peloton can leverage some of the existing physical infrastructure like the London studio to more easily stand-up operations.

Between the US, Mexico, and Spain, Spanish content can go a long way to test increasing Peloton’s demographic without the significant lift that comes with international expansion.

2. Producing French content

Growth Category: TAM Expansion // Growth Lever: Market Expansion

Strategic Importance: 4 • Business Value: 4 // Complexity: 3 • Cost: 4

By taking a language first approach, as discussed in the Spanish opportunity, Peloton could benefit from offering French content.

Like with Spanish, French also offers opportunities in Peloton’s core markets as, in Canada, there are 7.3M French native speakers (~22% of population), offering the opportunity to drive TAM expansion with minimal additional investments beyond content production.

Furthermore, French offers expansion opportunities in France, Switzerland, and Belgium. France is the third-largest fitness market in the EU at €2.6B in annual fitness revenue. In Switzerland, ~60% of the population speaks German and ~20% speak French (~6.4M in total) and there are approximately 4.5M French native speakers in Belgium (~40% of the population).

France, Switzerland, and Belgium are natural extension points to realize physical footprint synergies due to geographical location. As a result, expanding into these countries is merely an extension effort. Peloton can leverage the London studio and major distribution centers, as well as extend its last-mile delivery network, rather than build one from scratch.

Additionally, France, specifically, is a good intermediary step before expanding into its neighbor Spain.

Given the market expansion opportunity and investment synergies that can be realized, French content provides Peloton with the opportunity to test the approach before investing significantly.

3. Offering health and wellness analytics via wearable

Growth Category: SAM Expansion // Growth Lever: Increasing value

Strategic Importance: 5 • Business Value: 4 // Complexity: 2 • Cost: 2

Peloton strives to provide phenomenal health and wellness experiences, wherever you are. Unfortunately, a member’s time is mostly spent away from Peloton Digital, Bike, and Tread. By leveraging its ecosystem and expanding its offerings to serve members when away from their Digital and Connected Fitness products, Peloton has the opportunity to become a trusted health and wellness partner for its members.

With its subscription service, Peloton should offer a wearable that tracks a member’s vitals. Using this data can provide insights into new areas like sleep health, heart health, daily activity, etc., thereby offering a much more holistic experience.

The heart rate monitor that Peloton currently sells is only worn during workouts and thus is of no value for members when away from their Peloton products. And it isn’t even included with the subscription!

Peloton also recently announced that it supports Apple Watch GymKit on its Connected Fitness products. This is a step in the right direction, but this is not the best long term solution for Peloton as:

Peloton still doesn’t get access to the data when away from a Peloton

they are limited in the analytics they can run because Apple owns the data

not everyone has an Apple Watch, so this value proposition only applies to a select few

this is not a Peloton offering, it’s an integration, so this will not meaningfully drive sales for Peloton

By providing its own wearable, Peloton can show biological improvements beyond just qualitative results in how members feel in their bodies. Members can track their health and wellness results to see improvement and inspire better habits. As Peter Drucker has famously said, “If you can't measure it, you can't improve it.” This directly plays into Peloton’s mixed role of providing not just entertainment but fitness, health, and wellness results as well.

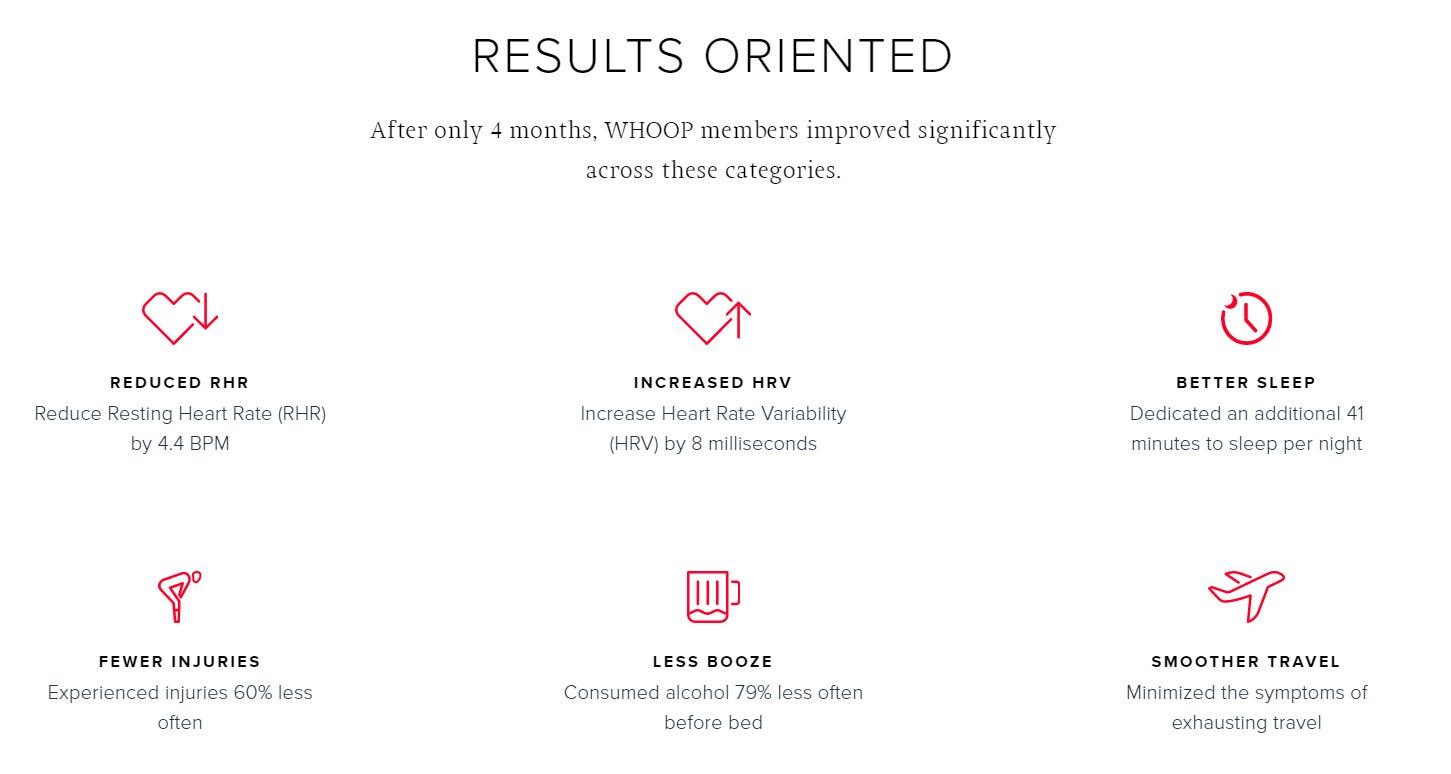

In this spirit, wearable company WHOOP provides analytics on its members’ sleep quality, recovery, and strain — how your body is reacting to things like stress, travel, and work. The key is that WHOOP can demonstrate results for its subscribers, as shown below.

Bear in mind that WHOOP has done this just by tracking metrics.

But what if Peloton could complement its products and content with the metrics like the ones WHOOP provides above? Peloton, which would have the capability to both track and offer fitness options, could deliver even better outcomes. This can spur further consumption of content as members will be further motivated to improve their health. For example, they might be motivated to do an extra workout, consume more meditation content to relieve stress, or even seek educational content from Peloton in the future.

Peloton could demonstrate that it’s helping its members be the best version of themselves and the world a healthier place.

This will also help with converting those that share a Peloton Bike or Tread to become a member. Many apartment buildings purchase a few Peloton Bikes or Treads for its residents to share. Peloton, though delivering value for the entire building, just benefits in the form of a few memberships. By adding benefits beyond the bike, Peloton can convert these users into members.

Peloton’s own wearable device would reinforce member loyalty to Peloton and generate demand for its products in ways that a third party could not.

4. Partnering with health insurers to subsidize memberships

Growth Category: SAM Expansion // Growth Lever: Increasing Affordability

Strategic Importance: 5 • Business Value: 4 // Complexity: 3 • Cost: 5

Currently, one of the biggest blockers in the way of the Peloton ecosystem is the cost of entry into the ecosystem. It is expensive to be a Peloton member. Even Peloton Digital, offered at $12.99 per month, while affordable, is not cheap.

An advantage that Peloton has is that it contributes towards societal good, but it is not currently benefitting from any of this value that it is generating and neither are its members. Improving one’s health takes stress off of the overall healthcare system. Every workout that Peloton can get someone to do, that they otherwise would not have done, saves the healthcare system money.

Peloton has the ability to demonstrate to health insurers that members are living a healthy lifestyle and could convince progressive health insurers to subsidize the cost of their membership and financial incentive to workout. Just like one can take a defensive driving course to save money on car insurance and have “Safe drivers save 40% with Allstate”, why can’t “Exercisers save 40% with UnitedHealth Group or Aetna”? Next-gen health insurers like Oscar Health offer $1 per day when you meet their daily step goal through a fitness tracker. A partnership rewarding Peloton members would lower the effective cost of a membership, enticing a larger population.

If Peloton is able to work with health insurers, the company should prioritize its efforts to expanding its offerings to cover more health and wellness topics like sleep and nutrition to deliver even better results and further reduce the effective cost.

This also further highlights the need for results-oriented and around-the-clock data analytics capabilities discussed in the wearable opportunity. The more proof in health improvements that Peloton can demonstrate, the more value it can show health insurers that its members get, and further reduce costs. Of course, patient data is a sensitive issue, so Peloton would have to present aggregated metrics showing the effect of its workouts on the overall member base and individual workout metrics only with strong consumer support.

Even though this provides no competitive edge, as competitors can form partnerships of their own, it is one of the best value-creating moves that Peloton can make. Because everyone benefits, there will be little harmful retaliation from competitors as discussed in McKinsey’s Valuation: Measuring and Managing the Value of Companies:

Peloton and the digital fitness industry have high contribution margins (i.e., high fixed costs, low variable costs), so this is a particularly value-creating opportunity for everyone. Ultimately, Peloton’s goal is not necessarily to defeat SoulCycle or Apple, but rather to generate economic profit. Lowering the effective cost of health and wellness products will do just that.

5. Refurbishing used hardware through a certified pre-owned (CPO) program

Growth Category: SAM Expansion // Growth Lever: Increasing Affordability

Strategic Importance: 4 • Business Value: 2 // Complexity: 5 • Cost: 3

Peloton can also offer lower prices by refurbishing products of churned users. Getting the Bike or Tread into the hands of another customer benefits Peloton by re-activating a subscription for the Bike or Tread.

Peloton has publically discussed that they are thinking about a certified pre-owned (CPO) program for the business, but admit that they have not been able to collect enough inventory with the $700 trade-in offer they have for Bike owners upgrading to Bike+. In John Foley’s words:

CPO is not a business that we can build without supply. It's not, we can't manufacture certified pre-owned. We need to get them back from our members and at this point the velocity that our members are interested in coughing up bikes is anemic at best.

They are finding that many are keeping their old Bikes (whether that be giving it to a family member or putting it in a second home) or selling through third-party channels where they can get unbeatable prices.

With this in mind, the question is: if third-party marketplaces are replacing churned subscribers with new ones, what additional value does Peloton have to offer?

The answer: one of the biggest reasons Peloton has invested in its logistics infrastructure is to make sure that it manages every touchpoint of their product and service offerings. Used product buyers are still new subscribers to Peloton and the delivery experience matters. Thus, Peloton should facilitate it and add value by:

leveraging its reverse logistics capabilities to manage shipping and handling of the product,

refurbishing the product and increasing trust in the marketplace with a quality product, and

providing insurance through fresh warranties to cover any issues with the product.

However, while this will provide better experiences for Peloton members, this will not move the CF subscriber growth needle. It comes down to: how many people will opt for Peloton’s program over third-party marketplaces and how many new transactions will this create?

Fundamentally, the third-party marketplaces will continue to have compelling economics for sellers for taking on extra work. Furthermore, there are approximately 92% of CF Products with an active subscription, implying ~100K CF products without an active subscription. Essentially, Peloton’s low churn means this has a ceiling of growing the subscriber base by <10%.

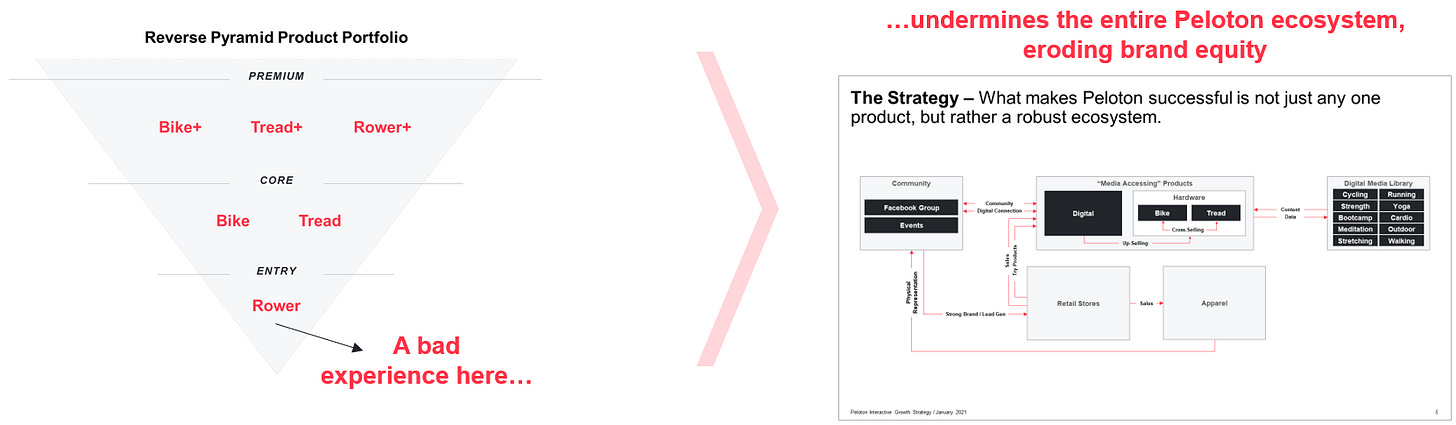

6. Positioning a rower to create a reverse pyramid product portfolio

Growth Category: SAM Expansion // Growth Lever: Increasing Affordability & Expanding Offerings

Strategic Importance: 4 • Business Value: 4 // Complexity: 2 • Cost: 3

In Bike and Tread, Peloton is priced at a premium and the cheapest product is nearly $2,000.

Peloton can expand its connected fitness SAM with the development of another SKU, but the company can really benefit from a low-cost hardware option positioned as an entry-level product to the ecosystem. Offering hardware in the $1000-1500 range would help open Peloton to get into the homes of even more people looking to get the power of Peloton hardware but cannot quite cough up $2,000 for a Bike.

Peloton, long rumored to offer a rowing device, has an opportunity to position a basic, entry-level Rower at ~$1,250-1,500 and a more premium Rower+ at ~$2,000+. Granted, the economics on this may not work out for a rower, specifically. But, NordicTrack’s touchscreen rowers at $999, $1,299, and $1,599 and Ergatta/Hydrow priced at ~$2,200 suggest that a dual-tiered approach a la Bike and Bike+ could work for a $1,250-1,500 Rower and $2,000+ Rower+.

This would help round out a reverse pyramid product portfolio that takes advantage of Peloton’s pricing power without foregoing the opportunity to capture customers sensitive to absolute price.

With that being said, an entry-level SKU should not be pursued if it tarnishes the brand’s promise for premium products at tremendous value. A strong brand is created over a long period of reinforcing actions. One inconsistent action can destroy years of brand building.

With the entry-level rower Peloton must be certain that the product will still be viewed as a premium, quality product at an affordable price point, preserving Peloton’s brand identity of premium products at tremendous value. If this is not achievable, Peloton should not pursue the entry-level variation.

7. Bringing connected strength and panel hardware to market

Growth Category: SAM Expansion // Growth Lever: Expanding Offerings

Strategic Importance: 5 • Business Value: 4 // Complexity: 2 • Cost: 3

While Peloton has some of the best workouts in the world, it skews towards cardiovascular fitness, leaving those looking to build strength underserved by Peloton. Peloton does have strength workouts through Digital, but all of Peloton’s other products are predicated on the premise that hardware (especially when connected!) improves the workout experience. The questions for strength are: does this same principle apply to strength, and, if so, what form should it take?

Intuition suggests the answer to the first question is yes, but the second is more challenging. Peloton’s value proposition is centered around bringing fitness into the home, where space comes at a premium. It is nearly impossible to be able to capture all of strength with a single machine, despite Bowflex’s valiant efforts.

Peloton probably has been hesitant with strength hardware because it requires Peloton to take on additional innovation risk that it hasn’t had to do with Bike or Tread. Bikes and treadmills have been fitness staples for a long time, so Peloton’s innovation risk only came from adding media experiences to the hardware, not inventing a new mechanism to workout.

Peloton’s best bet is probably to develop an offering that combines the best of Tempo and Mirror - traditional strength equipment and movements with instruction and classes delivered via panel hardware. The panel would provide Peloton two significant opportunities: (1) further building artificial intelligence capabilities to provide more personalized workout classes and (2) giving Peloton a centerpiece for the gym.

Using its sensors, a panel would provide additional data to not just provide better content recommendations but also provide more personalized experiences. It can work to integrate recommendations on form, suggestions on what weight is best for you, and encouragement when you are struggling. Subtle and minor tweaks can make all the difference in the quality of an exercise or stretch.

Secondly, Peloton can use the panel as a centerpiece of the gym. iPhone, Apple TV, or a rotated Bike+ screen are fine ways to consume Peloton content off of hardware. But, an iPhone screen is small, setting up a TV and Apple TV is not always sensible, and positioning a Bike+ to also offer an ideal floor space can be challenging. A panel would alleviate some of those considerations.

Furthermore, the panel can integrate with the Bike or Tread you have. For example, for bootcamps, the panel and Bike/Tread can work together to provide seamless content delivery when you are on and off the bike, or when you finish a workout, the panel could cue up and prompt a post-workout stretch.

The strength offering will give Peloton a core product that caters to a key fitness battleground.

8. Having retail stores double as community hubs

Growth Category: SAM Expansion & Penetration Improvement // Growth Lever: Increasing Value & Improving Distribution

Strategic Importance: 3 • Business Value: 2 // Complexity: 2 • Cost: 3

One of the most important parts of Peloton’s ecosystem is its community, a self-driving loop that spurs deeper engagement and demand for the other parts of the ecosystem. However, SoulCycle and Equinox, though lagging in their digital media content library, offer a strong community to compete with Peloton, largely due to their physical presence.

As such, this opportunity is bold and on the surface, a little counter-intuitive: Peloton could establish physical spaces where its members can meet in person. Peloton has obviously taken the world by storm by providing a fitness class experience outside of a gym and into your home. But just like Peloton is launching retail stores because customers touching, feeling, and experiencing Peloton drives more sales, in-person interactions, in tandem with digital experiences, drive a deeper sense of community than digital can alone.

With this in mind, Peloton could slightly pivot its retail strategy and turn stores into Peloton Studios that will offer members the ability to meet up in person with other community members and exercise together. This wouldn’t be intended to be the primary work out place of Peloton members; in fact, it should be an occasional workout experience to supplement workouts at home. Instead, most Peloton studios might look something more like a gathering space with a coffee shop, products on display up front, and a limited number of Bikes and Treads in the back for members to workout together.

Offering an in-person experience allows Peloton members to try the hardware that they don’t already have in their home. Touching, feeling, and experiencing a Tread can be just what a member needs to see the value of adding the Tread to their Bike at home. Furthermore, as Peloton Studios also serve as retail stores, potential customers can see and feel what was previously unobservable until after purchase, the Peloton community in action.

The community is just as important as the products and being able to actually experience it can make all the difference in converting a customer.

This is a risky bet. With that being said, Peloton can minimize risk — with the launch of its flagship studio in New York and one coming to London in 2021, Peloton can test this strategy before unleashing massive amounts of capital and remodeling its entire physical footprint. If they try and appeal to this strategy with the studio, the lift to the rest of the business may surprise them. Admittedly, capital and energy might be better deployed on higher priority items initially, but this could be a key converting retail experience for Peloton and it could be worthwhile to investigate accordingly.

However, I must admit that this doesn’t significantly contribute into Peloton’s priority of driving connected fitness subscriber growth and so it sits at the bottom of the totem pole.

9. Increasing selling & marketing spend / customer acquisitions costs

Growth Category: TAM Expansion & Penetration Improvement // Growth Lever: Fitness Education & Improving S&M Efficacy

Strategic Importance: 4 • Business Value: 4 // Complexity: 5 • Cost: 2

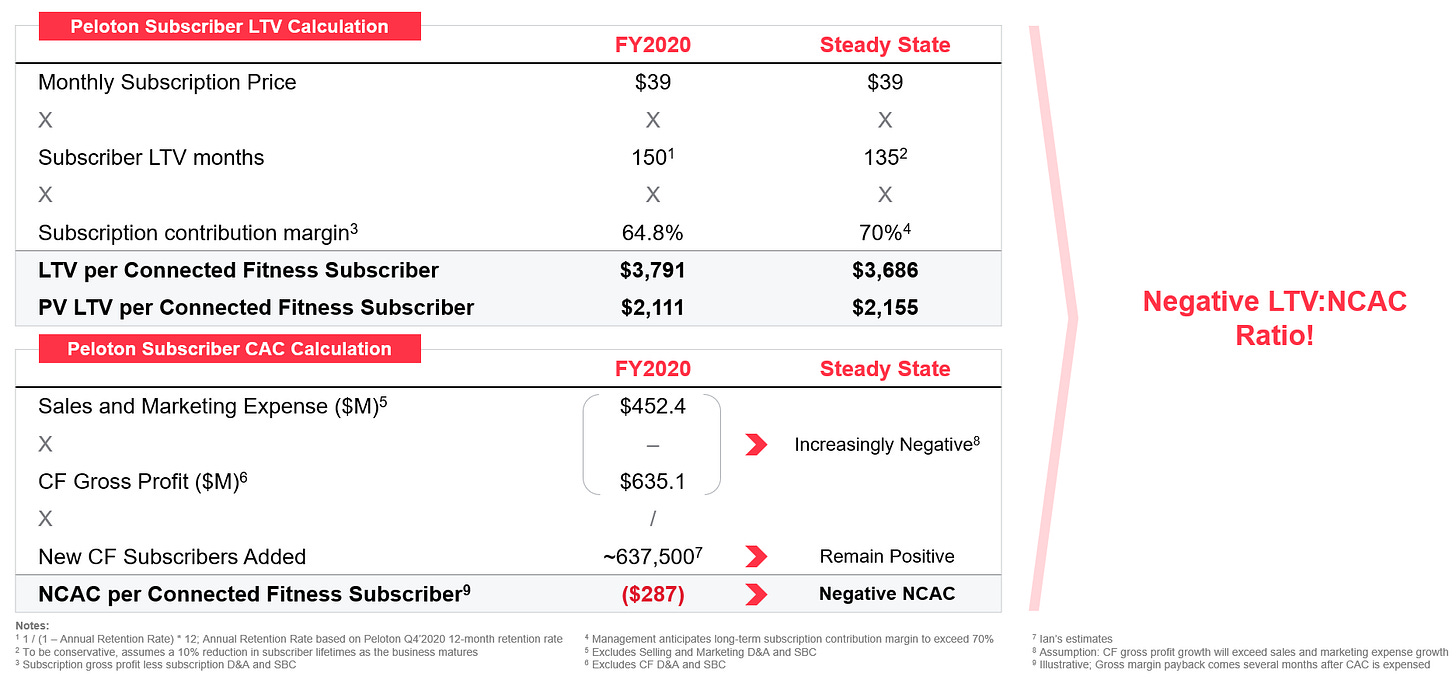

Peloton’s subscription business will increasingly become a larger part of the company. My estimates suggest subscription gross profit will exceed hardware gross profit by FY2025 and reach nearly $7B by FY2030.

If evaluated as a subscription business, Peloton has “off-the-chart” unit economics that are only getting better.

Because of this, Peloton should seek to keep selling and marketing expense equal to connected fitness gross profit for a few years.

This scenario implies no additional subscriber growth beyond as-is estimates. Thus, this represents the minimum increase in selling and marketing expense and the worst-case LTV/CAC ratio. As you can see, keeping selling and marketing expense in line with CF gross profit would maintain healthy overall unit economics even in the worst-case scenario!

Increasing selling and marketing expense will expand its leading position and accelerate scaling.

As mentioned in the beginning, the quicker Peloton captures the remaining market opportunity and increases its relative scale, competitors will be increasingly disincentivized to make investments that would erode value for Peloton.

If you have any questions, thoughts, or would like to connect, please don’t hesitate to reach out via Twitter or LinkedIn!

Fantastic article and very impressive research! Nice work