Peloton Interactive: An Ecosystem Strategy to Top The Leaderboard

Peloton's moat is deep, but not impenetrable. Three big bold bets could help keep Peloton atop the leaderboard for the long run.

COVID-19, though undoubtedly a global crisis and tragedy, can be credited with accelerating the digitization of our world by several years in just a few, tense months. We have seen marked growth in areas like online grocery shopping, video games, and streaming services.

Another such area is the fitness market and with the closure of gyms nation and worldwide, people have been looking for alternative ways to stay fit within the confines of their home. As a result, few companies have seen tailwinds as strong as those behind Peloton Interactive. Since FY2019, Peloton increased subscriber count by 113%, revenue is up 100%, and the stock is up over 300% since its IPO in September 2019.

While the company is on its way to becoming a giant in the health and wellness space, it has not quite secured its position atop the leader board just yet. To understand its path to winning the market, we’ll dive into:

Peloton’s purpose;

the ecosystem that makes Peloton so successful;

how it stacks up against the competition; and

how Peloton can get even further ahead of the pack.

01 Peloton’s Purpose

Blazing the digital fitness trail, one of the most important parts of Peloton’s business is its media product. Its media experiences are one of the main reasons why customers choose Peloton over its competitors.

Media companies are in the business of monetizing time and attention by offering some sort of content to consume. With this broad definition, although the New York Times and Xbox aren’t often considered similar, media companies with significantly different types of content are grouped together.

To make a little more sense of this category, we could consider the purpose of the content. Companies like Wikipedia, Google, and Yelp, offer useful information, a utility. Other companies offer entertainment, like Disney and TikTok. A third option is something in between—a hybrid of utility and entertainment—such as TED Talks, travel blogs, or business books.

Peloton fits this third category, seeking to deliver fitness, health, and wellness results and highly entertaining workout experiences. What makes Peloton able to successfully deliver this is not just any one product, but rather a robust ecosystem.

02 The Peloton Ecosystem

Bike, Tread, and Digital

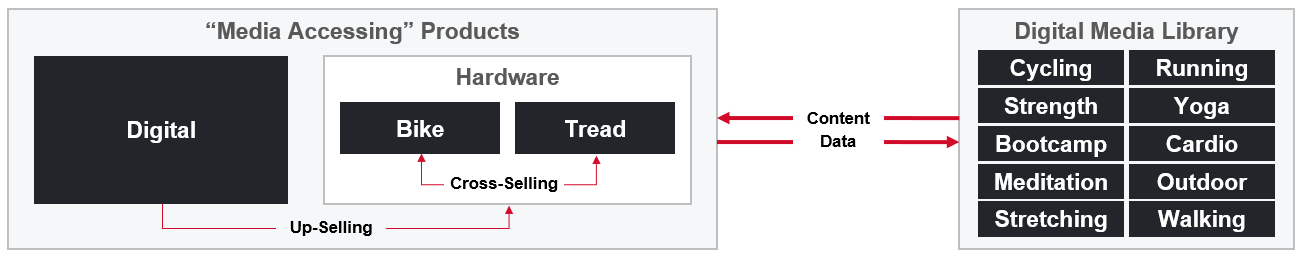

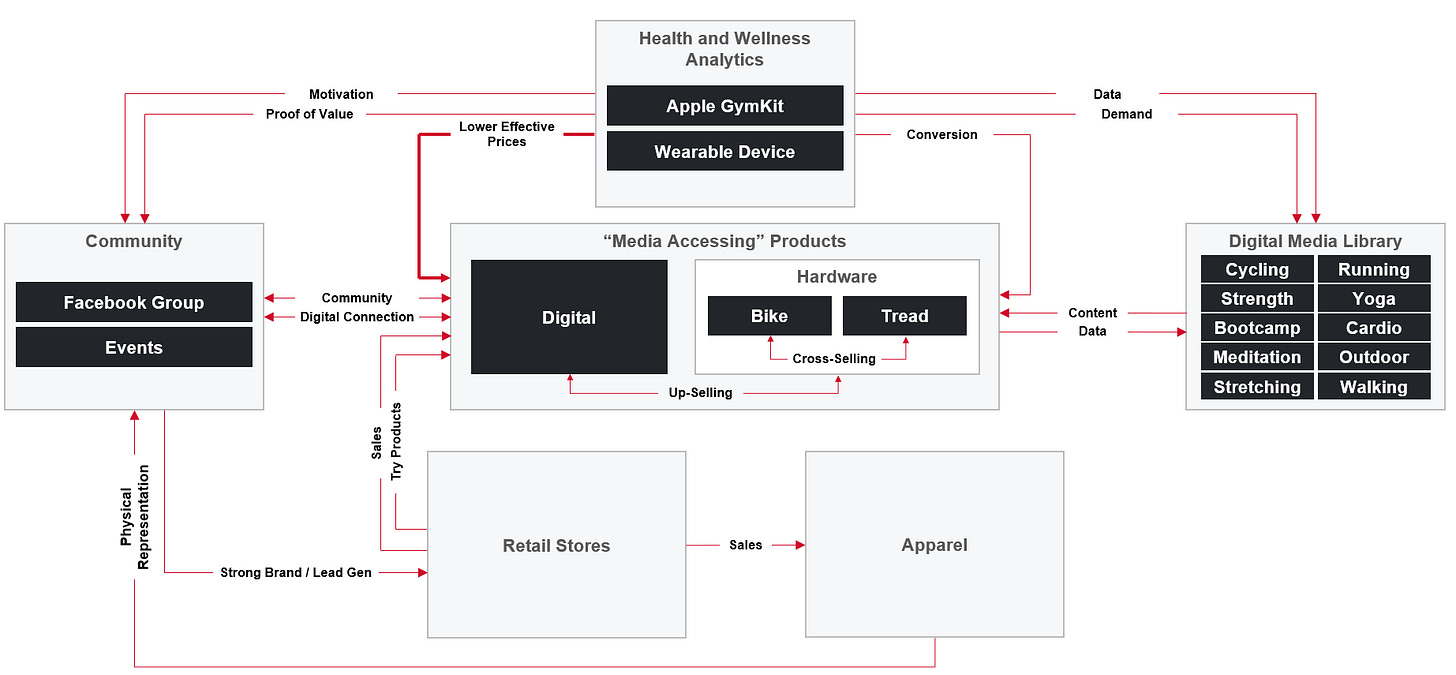

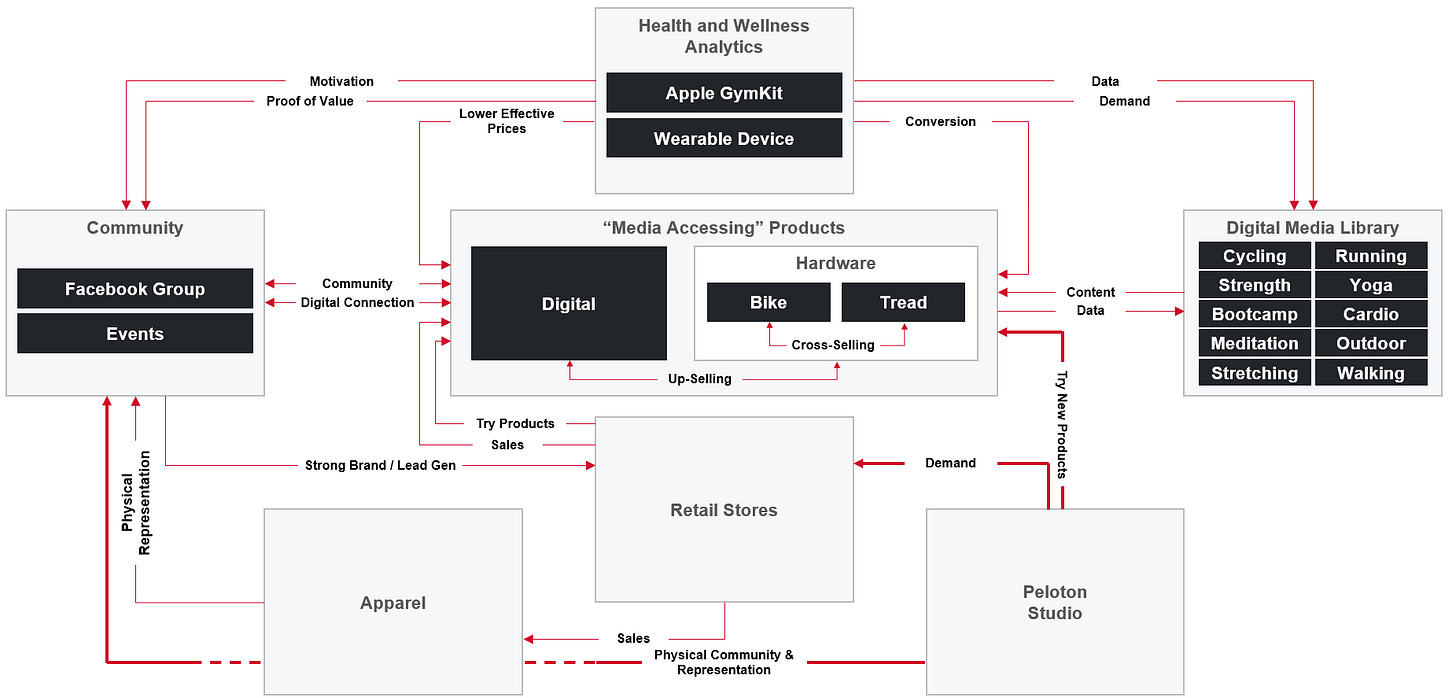

Peloton is much more than a bike. It is a full ecosystem whose experiences complement each other. At the center of this ecosystem are its core products—Peloton Digital, Bike, and Tread. Peloton Digital is an app that allows access to Peloton’s suite of in-home fitness, health, and wellness content for $12.99 per month. Peloton’s Connected Fitness products, Bike and Tread, priced at a premium $39 per month (on top of a few thousand dollars upfront), additionally give users fitness equipment to augment their workout experiences.

Digital is not a profitable standalone business. The team is aggressively pursuing user acquisition to realize profit via operating leverage, but it also serves a larger near and long term role as an entry point to the larger Peloton ecosystem. Digital introduces people to Peloton and the value of its Connected Fitness products, the hardware, which is the “golden goose” of the business as CEO John Foley has described it.

From Q4 2020 Earnings:

“While we believe we have the best digital fitness experience with the broadest and deepest assortment of high-quality programming, we continue to focus on Digital as an acquisition channel, and added value for our Connected Fitness Subscriptions. And we're excited to say that Digital is emerging as our fastest, growing lead generation channel.”

Digital is the gateway drug that lures you into the world of Peloton. You get the exhilarating taste of their workouts but can also be inspired to step up your game by adding a Bike or Tread.

Digital Media Library

Underlying Bike, Tread, and Digital is Peloton’s digital media library. As mentioned earlier, one of the most important factors that differentiates Peloton from its competitors is the quality of classes that it offers. Peloton carefully works to produce the highest quality content, working with 34 instructors to offer engaging, high quality live and offline workouts for its community.

The library of classes increases the value of the hardware to create more engaging workouts (and, of course, the app is virtually worthless without it).

Alone, the hardware is not much more than just another bike, and “just another bike” doesn’t generate much profit. The media experiences are a differentiator. In return, the Bike and Tread provide priceless data that helps Peloton understand how to provide continuously better experiences for its members.

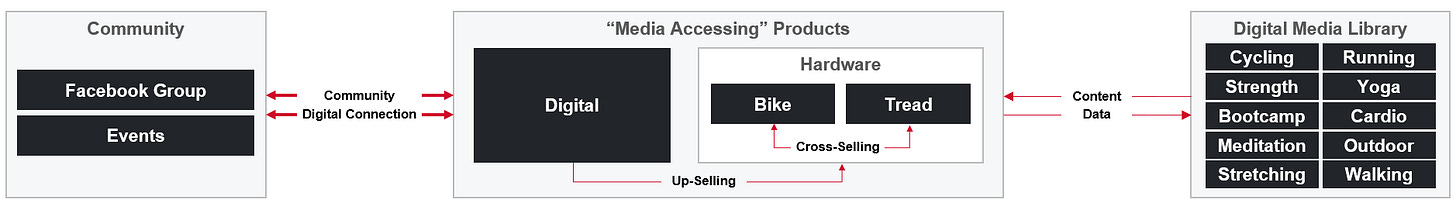

The Community

Working out together is fun, but because the bike is in your home, Peloton has had to get creative about how they develop community. To do so, Peloton allows you to:

follow a leaderboard for the live or on-demand class you are participating in,

develop your digital identity with tags and connect with other people in the community,

encourage other members with a digital “high five”,

follow friends,

video chat, and

join the Official Peloton Member Facebook page to receive updates and connect.

The community is one way that Peloton can play a role in its members’ lives the 23 hours per day they aren’t using Digital, Bike, and Tread, thus turning the company’s offering from an experience to a lifestyle. For example, within the official Facebook group, there are subgroups like the Official Peloton Mom group, Working Moms of Peloton, Peloton Moms Who Shop, and Peloton Moms Book Club. Peloton is more than just a one-off experience; it provides value around the clock.

Peloton, recognizing the importance of fostering this community, hosts an annual event called Peloton Homecoming. In 2019, 3,000 members joined together in NYC with many more participating in local meetups around the world.

The community and connection that members create with one another build strong attachment and loyalty to the brand that brings them together. Moving away from Peloton means also losing access to their Peloton community.

Apparel

As demonstrated by boutique fitness studios like SoulCycle, people love to represent the club that they are a part of. Peloton sells merchandise for members to represent Peloton with pride, showing appreciation for the brand and the community that they are a part of.

Albeit small, this is a revenue source for Peloton, but with such a strong fan base, it goes far beyond that. It is a way to make members even more excited to be part of the community and is a walking advertisement and testimony to the brand.

Retail

While word of mouth and the allure of the products, media experiences, community, and apparel pique the interest of customers, Peloton, understanding the importance of touching, feeling, and experiencing what they are about, use retail stores to convert customers. After first testing this idea in Short Hills, NJ, they have since expanded to over 70+ retail locations across the United States and the globe.

This completes an ecosystem that makes any one product more valuable than it would be as a standalone product.

03 How Peloton Stacks Up

It’s important to understand how this strategy will stack up against competitors. After all, strategy is only needed because competition exists. Competitors to Peloton include SoulCycle & Equinox, Mirror and Lululemon, Apple, Echelon, and Nordic track, and others. And the list is likely to grow—Amazon is lurking with the launch of its health wearable called Halo and investments in fitness startups Zwift, Tonal, and Aaptiv, as is Google with Google Fit and its acquisition of Fitbit.

Peloton is a category leader in the areas it competes in, but that does not make it invincible to competition.

SoulCycle x Equinox

SoulCycle and parent company Equinox together have formed Variis, a bike similar to Peloton’s. Their ecosystem most closely resembles Peloton, but it is not able to offer equivalent experiences.

With that being said, SoulCycle and Equinox have a formidable community. Given that both Equinox and SoulCycle have physical locations, their digital communities can form deeper relationships by meeting up in person. The physical relationships strengthen digital relationships and vice versa.

What SoulCycle and Equinox are missing is the depth of experiences that Peloton offers. Because they are later to the game, their media catalog is not as robust. Similar to Netflix which has had to invest heavily in content creation, SoulCycle and Equinox will have quickly build up their content library.

Apple

On September 15, Apple launched Fitness+, a fitness media experience centered around the Apple Watch for $9.99 a month. One of Apple’s advantages is its integration with Apple Watch because it can offer differentiated media experiences and unique analytics from what the Apple Watch is tracking. For example, during a workout an instructor may drive your attention to your heart rate, and the workout can bring your current heart rate to the screen. After the workout, Apple can show you health and wellness analytics, such as improvements in your cardiovascular health.

Apple’s other large advantage is its scale. Apple has the ability to attract customers that are already in its ecosystem and they are playing to this with Apple One, their subscription bundle. Furthermore, Apple can vastly improve its capabilities to build community by integrating activities further into iOS. Subscribers can invite their friends to workout via iMessage and use Memoji to form a digital identity for social interactions in workout experiences.

The biggest thing Apple is missing is what it typically is so good at — vertical integration. They currently are exercise equipment agnostic, which prevents them from creating a seamless connection between the media experience and hardware experience that Peloton can leverage. The reason for this is that it is not the fitness space that Apple is after. They want exposure to healthcare as a whole, a several trillion dollar market. Moving deep into the fitness market is trivial given their larger aspirations.

Lululemon x Mirror

Lululemon entered the fitness space with its $500M acquisition of Mirror. One obvious reason for doing so is that Lululemon sees an opportunity to expand the reach of their “lifestyle”. Mirror instructors will surely be wearing exclusively Lululemon apparel and Mirror can be leveraged as a tool to shop Lululemon products.

Starting with the retail and lifestyle side is a risky play, but if they can put the pieces together, they have the plumbing to create an ecosystem similar to that of Peloton’s.

NordicTrack, Echelon, and Others

Competitors like NordicTrack, Echelon, and others may offer hardware and media experiences but are missing the ecosystem plays that Peloton, SoulCycle x Equinox, Apple, and Lululemon x Mirror can offer. Without the ability to round out their experience with the benefits of a broader ecosystem, they cannot sustainably compete with their peers’ superior value propositions.

04 The Future of Peloton

Peloton’s robust ecosystem strengthens its brand and stickiness of its customers and the company has already reaped some of the rewards. However, as highlighted above, competition is fierce, and recognizing Peloton’s rise, they are arming themselves.

For Peloton, there is no time to celebrate, or else its leadership might be short lived. It must continue to grow, innovate, and provide phenomenal health and wellness experiences for its members. John Foley in Peloton’s recent investor day stated an ambitious goal to get Peloton to 100 million subscribers. It is an admirable goal, but to achieve it, Peloton cannot make shy, incremental moves, but rather bold bets.

Leveraging its strong foundation, Peloton should consider focusing its strategy around the following bold bets to maintain and further its lead against the rest of the pack.

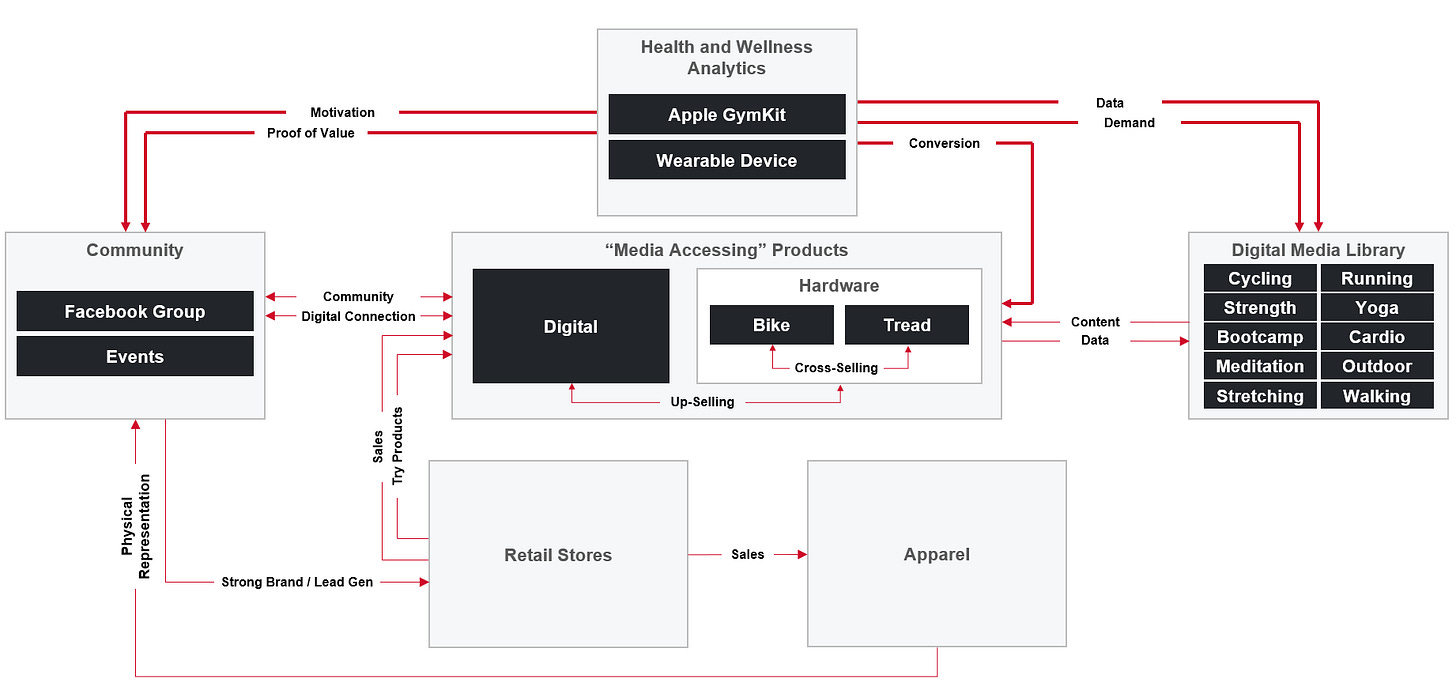

Bold Bet #1: Becoming A 24-Hour Health and Wellness Partner for Members

Peloton strives to provide phenomenal health and wellness experiences, wherever you are. However, a member’s time is mostly spent away from Peloton Digital, Bike, and Tread. By leveraging its ecosystem and expanding its offerings to serve members when away from their Digital and Connected Fitness products, Peloton has the opportunity to become a trusted health and wellness partner for its members.

With its subscription service, Peloton should offer a wearable that tracks a member’s vitals. Using this data, it can provide insights in new areas like sleep health, heart health, daily activity, etc., thereby offering a much more holistic experience.

The heart rate monitor that Peloton currently sells is only worn during workouts and thus is of no value for members when away from their Peloton products. And it isn’t even included with the subscription!

Peloton also recently announced that it supports Apple Watch GymKit on its Connected Fitness products. This is a step in the right direction, but this is not the best long term solution for Peloton as:

Peloton still doesn’t get access to the data when away from a Peloton

they are limited in the analytics they can run because Apple owns the data

not everyone has an Apple Watch, so this value proposition only applies to a select few

this is not a Peloton offering, it’s an integration, so this will not meaningfully drive sales for Peloton

By providing its own wearable, Peloton can show biological improvements beyond just qualitative results in how members feel in their bodies. Members can track their health and wellness results to see improvement and inspire better habits. As Peter Drucker has famously said, “If you can't measure it, you can't improve it.” This directly plays into Peloton’s mixed role of providing not just entertainment but utility as well.

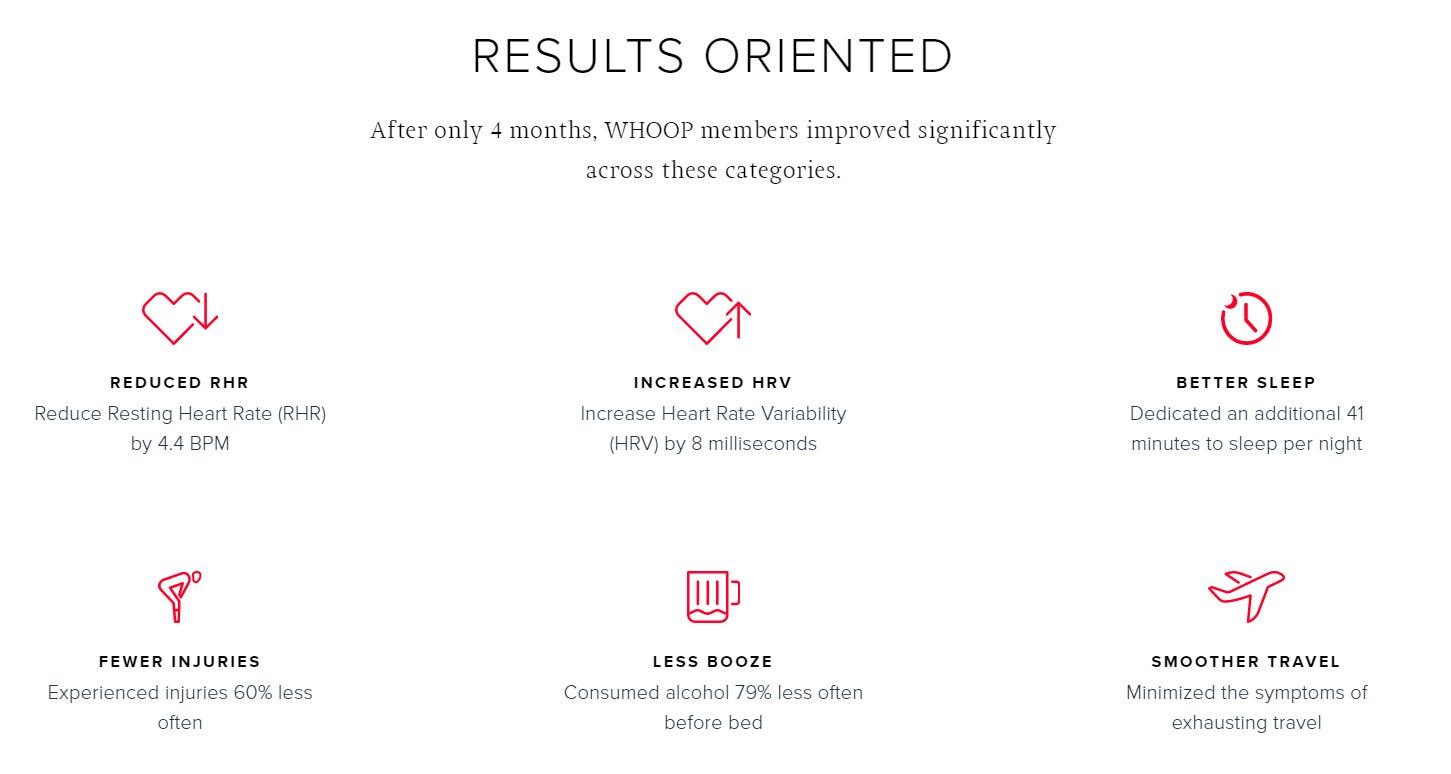

In this spirit, wearable company WHOOP provides analytics on its members’ sleep quality, recovery, and strain — how your body is reacting to things like stress, travel, and work. The magic ingredient is that WHOOP can demonstrate results for its subscribers, as shown below.

Bear in mind that WHOOP has done this just by tracking metrics.

But what if Peloton could complement those with the metrics like the ones WHOOP provides above? Peloton, which would have the capability to track and offer fitness options, could deliver even better outcomes. This can spur further consumption of content as members will be further motivated to improve their health. For example, they might be motivated to do an extra workout, consume more meditation content to relieve stress, or even seek educational content from Peloton in the future.

Peloton could demonstrate that it’s helping its members be the best version of themselves and the world a healthier place.

This will also help with converting those that share a Peloton Bike or Tread to become a Digital member. Many apartment buildings purchase a few Peloton Bikes or Treads for its residents to share. Peloton, though delivering value for the entire building, just benefits in the form of a few memberships. By adding benefits beyond the bike, Peloton can convert these users into members.

Peloton’s own wearable device would reinforce member loyalty to Peloton and generate demand for its products in ways that a third party could not.

Bold Bet #2: Reducing Customer Barriers to Ecosystem Entry

Currently, one of the biggest blockers in the way of the Peloton ecosystem is the cost of entry into the ecosystem. It is expensive to be a Peloton member. Even Peloton Digital, offered at $12.99 per month, while affordable, is not cheap.

An advantage that Peloton has is that it contributes towards societal good, but it is not currently benefitting from any of this value that it is generating and neither are its members. Improving one’s health takes stress off of the overall healthcare system. Every workout that Peloton can get someone to do, that they otherwise would not have done, saves the healthcare system money.

Peloton has the ability to demonstrate to health insurers that members are living a healthy lifestyle and could convince progressive health insurers to subsidize the cost of their membership and financial incentive to workout. Just like one can take a defensive driving course to save money on car insurance and have “Safe drivers save 40% with Allstate”, why can’t “Exercisers save 40% with UnitedHealth Group or Aetna”? Next-gen health insurers like Oscar Health offer $1 per day when you meet their daily step goal through a fitness tracker. A partnership rewarding Peloton members would lower the effective cost of a membership, enticing a larger population.

If Peloton is able to work with health insurers, the company should prioritize its efforts to expanding its offerings to cover more health and wellness topics like sleep and nutrition to deliver even better results and further reduce the effective cost.

This also further highlights the need for results-oriented and around-the-clock data analytics capabilities discussed in Bold Bet #1. The more proof in health improvements that Peloton can demonstrate, the more value it can show health insurers that its members get, and further reduce costs. Of course, patient data is a sensitive issue, so Peloton would have to present aggregated metrics showing the effect of its workouts on the overall member base and individual workout metrics only with strong consumer support.

Even though this provides no competitive edge, as competitors can form partnerships of their own, it is one of the best value-creating moves that Peloton can make. Because everyone benefits, there will be little harmful retaliation from competitors as discussed in McKinsey’s Valuation: Measuring and Managing the Value of Companies:

Peloton and the digital fitness industry have high contribution margins (i.e., high fixed costs, low variable costs), so this is a particularly value-creating bold bet for everyone. Ultimately, Peloton’s goal is not necessarily to defeat SoulCycle or Apple, but rather to generate economic profit. Lowering the effective cost of health and wellness products will do just that.

Bold Bet #3: Creating an Omni-Channel Community

One of the most important parts of Peloton’s ecosystem is its community, a self-driving loop that spurs deeper engagement and demand for the other parts of the ecosystem. However, as noted above, SoulCycle and Equinox, though lagging in their digital media content library, offer a strong community to compete with Peloton that is largely due to their physical presence.

As such, Bold Bet #3 is bold and on the surface, a little counter-intuitive: Peloton could establish physical spaces where its members can meet in person. Peloton has obviously taken the world by storm by providing a fitness class experience outside of a gym and into your home. On top of just being an innovation for customers, the scaling potential makes Peloton a more profitable business. But just like Peloton is launching retail stores because customers touching, feeling, and experiencing Peloton drives more sales, in-person interactions, in tandem with digital experiences, drive a deeper sense of community than digital can alone.

With this in mind, Peloton should slightly pivot its retail strategy and turn stores into Peloton Studios that will offer members the ability to meet up in person with other community members and exercise together. This isn’t intended to be the primary work out place of Peloton members; in fact, it should be to be an occasional workout experience to supplement workouts at home. Instead, most Peloton studios might look something more like a gathering space with a coffee shop, products on display up front, and a limited number of Bikes and Treads in the back for members to workout together in the back.

Offering an in-person experience allows Peloton members to try the hardware that they don’t already have in their home. Touching, feeling, and experiencing a Tread can be just what a member needs to see the value of adding the Tread to their Bike at home. Furthermore, as Peloton Studios also serve as retail stores, potential customers can see and feel what was previously unobservable until after purchase, the Peloton community in action.

The community is just as important as the products and being able to actually experience it can make all the difference in converting a customer. Combining the retail stores with the studio would help Peloton be more efficient with its footprint than having the two standalone.

Obviously, this is a risky bet. With the launch of its flagship studio in New York and one coming to London in 2021, Peloton can test this strategy before unleashing massive amounts of capital and remodeling its entire physical footprint. If they try and appeal to this strategy with the studio, the lift to the rest of the business may surprise them. Admittedly, capital and energy might be better deployed on higher priority items initially, but this could be a game changer for Peloton and they should investigate accordingly.

Closing Thoughts

Peloton has seen tremendous success by defining a new category, vertically integrating, and creating an ecosystem that is difficult to compete with. However, the company has demonstrated that there is significant opportunity in the Connected Fitness market, and as a result, competitors are vying to take a piece of the pie.

To maintain its lead and “win” the connected fitness market, Peloton needs to strengthen its value proposition and deepen its moat with health analytics to demonstrate results and a physical community so members never want to leave the world of Peloton.

If you have any questions, thoughts, or would like to connect, please don’t hesitate to reach out via LinkedIn or Twitter!