Stitch Fix: A Strategy Fit for the Occasion

Stitch Fix is in the pole position to disrupt retail e-commerce but must continue to push forward in bold new ways. In this piece, I identify and evaluate its different options.

Stitch Fix, founded in 2011, has grown to $1.7B in annual revenue by combining data science and human judgment to deliver apparel, shoes, and accessories personalized to customers’ individualized tastes, lifestyles, and budgets.

The company’s unique approach to bringing personalization and customization to the shopping experience in a world plagued with standardized shopping experiences has led some to lofty expectations.

When you walk into an apparel store, you are presented with a number of items that are not relevant to you in any way. Whether it be the wrong size, a pattern you’d never wear, or a cut that doesn’t suit you, there is a lot of “noise” in your path to finding items that you truly love. Consumers are left to navigate through this noise.

To date, e-commerce companies have focused on simply making everything available for purchase online, stealing market share from traditional brick and mortar stores through more convenient shopping experiences and competitive prices. This works well for commoditized goods or when customers already know what they are looking for.

However, when the customer is not sure what he or she is looking for, there is an opportunity to provide a much more informative experience. Stitch Fix aims to provide an experience that actively helps people find the clothes that will be a joy for them to wear. They do so by creating a shopping experience where every item on its “clothing rack” is not just your size, but also has the styles, fits, and fabrics that you will love.

Stitch Fix initially started with a small “clothing rack”. The company sends you five items in a shipment they call a “fix” based on a style profile and a stylist's picks. Simply, keep what you love, return what you don’t, and provide some feedback. Stitch Fix has also begun to expand its “clothing rack” through an offering called Direct Buy, a larger, digital clothing rack to browse through. Customers can easily browse through curated items with a high probability that they will love them.

In both models, customers begin by taking a style quiz to form an initial understanding of tastes and preferences. Improving over time, Stitch Fix also iteratively finds the customer’s sweet spot for clothing style & shape based on customer feedback (e.g., “This isn’t my style”, “These pants are the right size but a poor cut”).

With an understanding of the types of clothes a customer likes, the company matches them with inventory available and the feedback loop begins again, continually building and refining a representative model of the customer preferences.

Stitch Fix leverages this customer data in two ways: (1) using it to inform what clothes to purchase from apparel companies and (2) matching customers with available inventory.

Clothing is an opportune product to apply data science to because:

behind the art of fashion lie quantifiable determinants of fit (i.e., modeling the geometry of the clothing) and style (i.e., patterns, colors, fabrics, etc.); and

there are relatively quick feedback cycles as many customers purchase clothes multiple times per year.

This data not only helps Stitch Fix curate better clothes but also helps them create clothes. In addition to selling clothes from third parties like Bonobos or Kate Spade, Stitch Fix designs its own clothes through its own exclusive labels as well. Its unique understanding of consumer tastes and preferences can help them produce better-selling clothes with higher margins.

While the company is a trailblazer, the company must continue to innovate. With such a compelling value proposition and foundation, what does Stitch Fix do now? The company must continue to identify opportunities to uniquely serve customers better.

In this piece, we will go through a strategy formulation process to help Stitch Fix answer:

“Where should Stitch Fix play and how will it win?”

The intended output is to produce a few initiatives to help the company achieve meaningful and profitable growth. To do so, we will structure this problem into 7 steps:

Aim - Pinpoint the strategic business objectives to optimize for.

Structure - Identify value paths and associated levers.

Empathize - Understand key customer “Jobs to be Done” to improve experiences.

Ideate - Propose opportunities to meet business and customer needs.

Prioritize - Separate out the most promising ideas to focus evaluation on.

Hypothesize - Ask “What would have to be true?” to create hypotheses to test.

Execute- Envision the future and turn it into a reality.

This is not intended to be a holistic, picture-perfect view of Stitch Fix’s strategic possibilities, as doing this alone with only publicly available information is limiting. Instead, the intention of this piece is to show that:

The strategy process leveraged in this presentation would be powerful when performed by a group of cross-functional stakeholders who can provide a collectively deep and diverse set of expertise.

The ideas provided in this presentation can serve as an inspiration and/or foundation for strategic possibilities for Stitch Fix to consider.

Let’s dive in!

01. Aim

For Stitch Fix, each new customer order improves the company’s ability to serve everyone. As such, the company’s competitive advantage is a derivative of its network effects – as its relative scale increases, Stitch Fix will be able to better serve customers, and competitors will find it increasingly difficult to offer as compelling a customer experience.

Market entrants will run into a chicken or the egg problem: to make good recommendations they need customers to provide them with data – and vice versa. To make matters worse, over time, customers will increasingly expect greater experiences out of the gate. Time is not on their side.

But, context is important. Though Stitch Fix has a leading position, much of the market is still up for grabs. The largest player, due to its supply-side economies of scale and demand-side network effects, will be able to offer the most compelling consumer value proposition.

As a result, growth should be a priority for Stitch Fix. More specifically, the key metric Stitch Fix should be optimizing for is the number of items kept by customers. This metric reflects a delightful customer experience that further drives the company’s network effects and its magnitude reflects Stitch Fix’s scale, an important part of offering the best experience relative to competitors.

With the strategic direction set, we can now look to frame and structure our potential paths.

02. Structure

To help us think through this objective, we can break it down further. To increase the number of items kept by customers, we can:

increase items kept by improving share of “current wallets” – the portion of a current customer’s spend that Stitch Fix is currently competing for

increase items kept by accessing “new wallets” – a categorical portion of a consumer’s spend that Stitch Fix is currently not accessing or competing for

which we can break down further into value levers:

increase items kept by improving share of “current wallets”

Increase customer item order rate

Increase customer item keep rate

increase items kept by accessing “new wallets”

Increase market penetration

Increase the number of SKU types Stitch Fix offers

Expand the number of markets Stitch Fix plays in

Within each of these opportunity areas, there are several value drivers that can make an impact.

With the different business objectives and value paths identified, we can move on to understanding the customer needs.

03. Empathize

To help us understand customer needs that Stitch Fix can address, we’ll use a persona-based approach to build empathy with hypothetical customers. To represent a broader set of potential customers, we’ll look at three different personas with different characteristics:

Ayesha, The Mall-Going Mom

Brandon, The Reluctant Shopper

Carly, The Stitch Fix Fanatic

Understanding each person’s different background and shopping habits will help us in uncovering a variety of ways Stitch Fix can play a role in customer’s lives. Note that this doesn’t imply that Stitch Fix should address every need, but rather is intended to provide a view of current shopping experiences.

Accordingly, I’ve put together some context behind what Ayesha, Brandon, and Carly are looking for in a shopping experience, some of their pain points, and opportunity areas to improve the experience.

Note that these personas are not grounded in consumer research, but instead are made up to illustrate findings that might surface from consumer & journey-based exercises.

To make better sense of the personas’ pain points and opportunities, we can cluster them into pain point and opportunity areas.

These opportunity areas will be important to consider when generating strategic opportunities.

With the persona pain points and opportunities in context and categories & levers identified, we can now move onto ideation.

04. Ideate

With Stitch Fix’s business & customer needs as a foundation, it is time to ideate on how to meet these demands.

Instead of going through each idea here, below is a summary, with deep dives on the opportunities at the bottom of this article. Feel free to browse through the opportunities as you wish!

05. Prioritize

With a slate of potential initiatives, what does Stitch Fix do next? Analyzing all of these opportunities in detail would be an inefficient use of time and resources.

Instead, we can develop a framework to prioritize the most promising initiatives, saving the others in an initiative bank for investigation at a later date.

Ultimately, the most important considerations for an opportunity are:

What kind of impact can this opportunity make?

How difficult would it be to implement this opportunity?

To provide a little more clarity around the questions, we can break it down further and develop a scoring framework on top of it:

What kind of impact can this opportunity make? (65% of total score)

What is the strategic importance of this opportunity? (40% of impact score)

How much business value does this provide? (60% of impact score)

How feasible would it be to implement the opportunity? (35% of total score)

How complex would it be to implement the opportunity? (40% of feasibility score)

What is the cost of implementing the opportunity? (60% of feasibility score)

Note that they are not equally weighted because impact, business value, and cost are slightly more important than their respective counterparts.

Rolling up our opportunity scores from the deep dives section results in the following.

We can rank the scores to determine where we should focus our effort to fully evaluate.

The map on the left can also help us understand the relative risk-reward profiles of each opportunity.

As determined by our scores, the most promising opportunities are:

Stitch Fix as a Service

Eyewear

International Expansion

Clothing Personalization

While these opportunities hold promise, we still need to investigate them further to validate them. They may not hold up.

Accordingly, the next step is to validate them. We can also always come back to other opportunities at a later time.

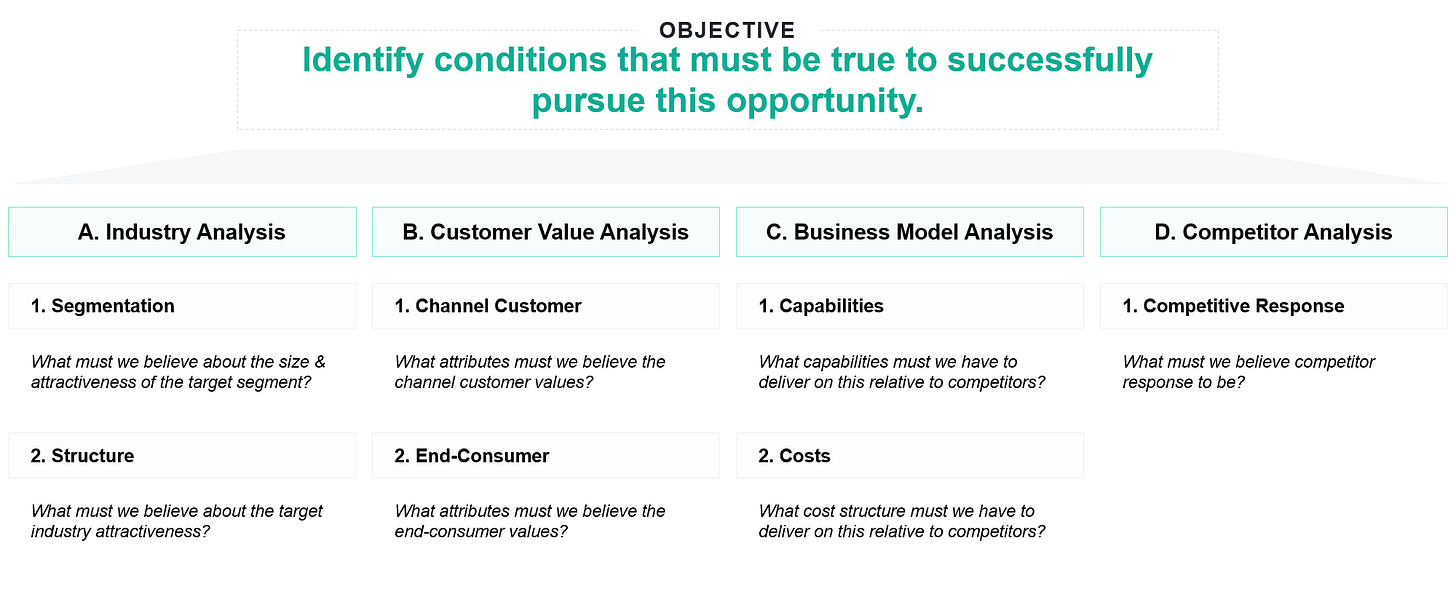

07. Hypothesize

To analyze these ideas further, instead of speculating on whether these initiatives are going to be successful, we can take the guesswork out of the equation and reverse-engineer the logic by asking “what would have to be true for this to be successful?”. Doing so will create a list of hypotheses to test that can help assure us that it is a promising opportunity.

To perform this we can leverage the approach from Roger Martin’s Playing to Win to be as efficient as possible with time and resources by:

Developing hypotheses against the “What must be true?” evaluation criteria.

Ranking them in order of least to most likely to pass.

Designing tests and defining success criteria to evaluate the hypothesis.

Testing hypotheses in rank order.

If a hypothesis fails and the initiative cannot reconcile with the finding while maintaining value, there is no need to continue. Otherwise, continue to the next test.

To help come up with hypotheses, we can use Martin’s framework by thinking across industry analysis, customer value analysis, business model analysis, and competitor analysis as a guide for hypothesis development.

Using this, I’ve come up with the following hypotheses to test for our four candidate opportunities:

Stitch Fix as a Service

Sharing inventory and customer data would not be a dealbreaker for companies.

A sufficiently large number of apparel companies would be willing to open their technology stack to a retailer’s software solution.

Stitch Fix has the ability to develop an enterprise-grade SaaS solution.

Consumers would want style & fit personalization recommendations and feedback to be translatable between channels.

Eyewear

Stitch Fix can develop merchandising partnerships with eyewear manufacturers to sell through its channel.

Competitors will struggle to match Stitch Fix’s matching algorithms & data science capabilities

A sufficiently large number of people would want better personalization of eyewear based on their style and fit needs.

International Expansion

Customer data from another country will meaningfully help make better algorithmic decisions in other countries (i.e., contribute to the company’s data network effects).

Consumers would be willing to purchase clothing through a direct-to-consumer channel and provide feedback.

Stitch Fix can develop merchandising partnerships with clothing manufacturers to sell through its channel.

All else equal, consumers would value a channel that helps them identify clothes that are going to fit them well.

Regional competitors are not equipped with the data & analytics capabilities to successfully match Stitch Fix’s personalization capabilities.

Clothing Personalization

Stitch Fix has the capability to develop or integrate an innovative manufacturing process.

Stitch Fix has the capability to create or integrate a clothing design platform.

Integrating into the value chain to provide personalized products would be growth & profitability accretive at some level of personalization and an achievable level of scale.

A sufficiently large number of people would purchase clothing from one company over another because of increased product personalization.

All else equal, consumers would choose a more personalized clothing item than items that are available today.

With the tests outlined, the next step would be to conduct the tests, analyze results, and continue, refine, or abort the initiative as required.

08. Execute

Assuming the initiatives pass the testing, to go from validated concept to reality, Stitch Fix can follow the below process flow: Envision, Design, Assess, Build, Evaluate, and Scale.

Doing so will enable Stitch Fix to have a clear direction of its path forward while maintaining flexibility to adapt to new learnings.

If Stitch Fix successfully does this, the company will be well set up to take advantage of its pole position to disrupt retail e-commerce by pushing forward in bold new ways.

Closing Thoughts

Stitch Fix has a tremendous opportunity to trailblaze how we think about apparel and associated shopping experiences by leveraging high-quality customer data.

To conclude, a few key takeaways:

Stitch Fix’s priority should be growth to take advantage of and improve its leadership position and the scale economies and network effects that come with it.

To grow, Stitch Fix can tap both new and current wallets.

The most promising opportunities are the ones that deepen and extend Stitch Fix’s core competency of helping people find the items they love in new ways.

Data provides a competitive advantage, however, it’s important to not develop an over-reliance on data. Inherently, data reflects the past and what customers think they want. Stitch Fix must ensure that data is used as a component of the puzzle, not the sole answer.

Stitch Fix should view this as a starting point and be nimble enough to alter the strategy and roadmap as priorities and competitive landscapes evolve.

Everything here merely sets the stage for potential value creation - without exceptional execution, these opportunities will not yield meaningful results.

In sum, Stitch Fix wins by developing an understanding of what it uniquely does best, how that can be best applied in new ways, and executing exceptionally well.

Below, you can find a deep dive on each opportunity – feel free to browse through the ones that are most interesting to you.

If you have any questions, thoughts, or would like to connect, please don’t hesitate to reach out via LinkedIn or Twitter!

Opportunity Deep Dives

Opportunities

Clothing Personalization

Content to Commerce & Use

Stitch Fix as a Service

Rental Program

Eyewear

Beauty Products

International Expansion

1. Clothing Personalization

Value Category: Improve Share of Current Wallets

Value Lever: Increase Keep Rate

Customer Opportunity Area: Establish and build trust in the shopping journey

The first era of e-commerce prioritized speed and price, but Stitch Fix is ushering in the second wave of e-commerce that prioritizes personalized curation. Trailblazing the second wave also sets Stitch Fix up well for what I believe will be the third wave of e-commerce, which will not help you find goods and services well suited to you, but instead will custom-build them for you.

This third era of e-commerce would seal Stitch Fix’s disruption of apparel. The combination of owning the customer relationship (and the associated data) and the tailored supply chain to produce customized pieces arms Stitch Fix with a vertically integrated value chain. Barriers to entry and barriers to compete would be nearly insurmountable due to the innovation and scale required.

The path to true personalization at scale will be slow, but it isn’t a new trend. Apparel sizes (i.e., a “medium” t-shirt or “size 6” pants) are a simple form of clothing personalization and brands of late have been offering lines that offer similar cuts, making it easier for you to identify clothing that fits your body type well.

The challenge is that it is difficult to increase personalization economically. There are two problems with further venturing deeper down this path:

Slow, Unspecific Feedback Loops: Apparel companies have little feedback on what specifically is or isn’t working with their clothes. Companies are using sales data and focus group feedback to extrapolate and make educated guesses on what will fit customers well.

Lack of Individualized Data: With a lack of data at the individual customer level, clothing lines are created for segments of customers – someone that looks like you – resulting in generalized personalization.

Stitch Fix can move past these barriers with their model because of the specific, individualized feedback they get from customers.

So how does Stitch Fix implement this? Do they become a custom-tailored clothing company at scale? Perhaps eventually, but certainly not to start.

Level Zero

To start, the most important part is to get really good at matching customers with clothes based on their “dimensions” – neck width, torso size, arm width, etc. – which the company is already getting better at every day.

Level One

The next iteration of this would be to not just match customers with clothes, but actually design clothes that will match with customers.

For most apparel companies, the largest barrier to personalization is the availability of data. With a granular understanding of detailed clothing preferences beyond simplistic clothing sales, Stitch Fix can overcome this hurdle and create clothing with a high likelihood of meeting customer wants and needs.

Similarly, Stitch Fix is already getting better at this every day with its exclusive brands.

Level Two

With the ability to create clothing based on detailed customer preference data, a new challenge quickly presents itself to achieve the next level of personalization. With better data, Stitch Fix would not be truly increasing personalization, but rather is simply creating better-fitting generalized clothing. In other words, they’re making clothing lines, just like J. Crew, but are able to be more precise in their clothing dimensions and match them with the right customers.

To increase personalization is to increase the number of segments – i.e., the number of clothing lines. However, this adds additional design load as designers must account for a larger number of segments.

To solve for this, instead of a designer specifying exact dimensions, clothing dimensions need to become a more abstract part of the design process. Using a video game engine or other 3D CAD software like CLO, the designer can simply envision how their clothes look should look. This allows them to focus on the more creative aspects of design like how the item should fall on a body, how it reacts to movement, and how it looks in different lighting.

Then, specific dimensions would be calculated algorithmically for different customer segments, helping the designer focus on more valuable work.

Over time, the goal would be to increase the granularity of the customer segments and the number of clothing dimensions to customize.

Level Three

As the number of customer segments increases, it won’t make as much sense to “hard code” the manufacturing process. Instead, machinery must be able to dynamically manufacture different clothes based on dynamically changing, variable inputs.

This would be a complex endeavor for Stitch Fix to take on, but the reward is a fully integrated value chain and the ability to capture the tremendous value that comes alongside it.

Is this worth it?

Customers value clothing that fits them well and will always prefer an item of clothing whose fit is more personalized to them, all else equal. However, the incremental value of personalization is diminishing, and the incremental cost of personalization is increasing.

The beauty of this opportunity is that Stitch Fix can dial the personalization up or down to the optimal level and scale investments proportionally. For example, if Level Three isn’t needed, simply, don’t do it!

Regardless of the ideal level of personalization, Stitch Fix’s unique access to granular customer data enables it to always have a cost advantage against competitors, all else equal.

Scoring

Strategic Importance: 5

Aligns with Stitch Fix’s value proposition of uniquely helping people find items to wear that they will love

Drives increase in items kept by customers through higher quality merchandise, lifting keep rates

Increases defensibility due to value chain complexity & integration

Business Value: 5

Drives higher-margin, exclusive label sales

Value chain integration increases capturable value

Complexity: 1

Requires significant R&D and new IP to deliver a design and dynamic manufacturing platform

Expands the scope of Stitch Fix’s business, adding complexity to operations

Cost: 2

Requires funding for software development and hard asset purchases / leases and R&D investments

This opportunity affords flexibility and incremental investment as business cases become clearer

2. Content to Commerce & Use

Value Category: Improve Share of Current Wallets

Value Lever: Increase Keep Rate

Customer Opportunity Area: Curate to increase buyer control & ownership of the experience

As popularized by Clayton Christensen in Competing Against Luck, a helpful construct to think about business is consumers hiring a product or service to accomplish a specific job to be done.

There are two types of hires a customer makes:

Big Hires: A customer deciding to purchase the product.

Little Hires: A consumer deciding to use the product.

Often, companies over-index on the big hire, forgetting about the little hires. The moment a consumer makes a purchase, that product is still waiting to be hired again – the little hire. If a product truly solves the job, there will be many moments of consumption. It will be hired again and again.

The reward for getting both hires right is a purpose brand that becomes synonymous with the job, stopping a consumer from even considering looking for another option and command a price premium for this guidance. They provide remarkable simplicity & clarity for customers.

Stitch Fix does a fantastic job by curating the right selection of clothing, removing certainty from the purchase decision – the big hire. However, Stitch Fix has an opportunity to improve how they guide customers on how and when to make the little hires. The company offers visual guidance through a couple of instances of how to pair the item and they have a men’s fashion blog, but this visual advice is superficial, and the blog is not a particularly seamless experience.

To this end, Stitch Fix can create better relationships with customers by guiding them through the little hires. If done successfully, this will strengthen retention, improve long-term conversion, and add yet another competitive barrier.

After purchase, customers are left to their own devices to incorporate the item into their wardrobe. However, data science can only go so far in making recommendations. It doesn’t have a great understanding of the social circumstances around choosing an item of clothing – it’s better at sticking to making quantitative assessments.

As such, Stitch Fix should leverage content to help provide more product context. Providing product-relevant content can help Stitch Fix provide guidance throughout the entire lifecycle of a product, building longer and more meaningful customer relationships.

To improve this, Stitch Fix can link pieces of internal and external content on product pages.

The net effect of this is that content will help Stitch Fix become a purpose brand by facilitating both upfront commerce and later use.

Together, these impacts propel Stitch Fix to becoming a high-trust, purpose brand.

Scoring

Strategic Importance: 4

Increases Stitch Fix’s ability to facilitate “big hires” and “little hires”, resulting in the development of a purpose brand

Increases items kept by customers through higher keep rates from better upfront guidance

Increases barriers to compete

Business Value: 3

Increases sales through higher keep rates

Decreases cost of revenue through lower return rates

Complexity: 3

Requires building a strong media / content creation capability

Requires building software to curate relevant third-party content

Cost: 3

Requires hiring in-house content creators

Software development investments are required

3. Stitch Fix as a Service

Value Category: Improve Share of Current Wallets & Access New Wallets

Value Lever: Increase Order Rate & Increase Market Penetration

Customer Opportunity Area: Establish and build trust in the shopping journey

Apparel companies have been looking to move away from distribution partners by taking a direct-to-consumer approach. The first reason is simply that D2C business models are more profitable. There is one less middleman that needs to take a cut.

The second reason is that the company has more control over how its products and brands are presented to consumers. For example, Nike stopped selling its products on Amazon, where it was just another shoe among millions of search results. It has no opportunity to showcase its powerful everyday athlete story and how that is manifested in the product.

This is a similar reason why Steve Jobs was adamant about Apple opening retail stores, despite this strategy failing for other tech companies. No one is going to care about showcasing your product as much as you are!

There will be brands that are not interested in selling to Stitch Fix, despite the innovative model. There is context like the brand/product story – e.g., Nike’s everyone is an athlete positioning – that an aggregator like Stitch Fix does not portray that can help inform whether someone will love an item (or even cause them to love an item!).

On the other hand, Stitch Fix, as a retailer, has just one channel – stitchfix.com – resulting in extreme dependence on its success. Though it very well may be, there is no certainty that it will be successful in the long term.

To solve for this, Stitch Fix can take a lesson from Jeff Bezos and Amazon and make a bet on personalized, curated shopping experiences holistically, not just for one channel.

In 2002, Jeff Bezos sent a memo to the company stating that all development had to be externalizable:

1) All teams will henceforth expose their data and functionality through service interfaces.

2) Teams must communicate with each other through these interfaces.

3) There will be no other form of interprocess communication allowed: no direct linking, no direct reads of another team’s data store, no shared-memory model, no back-doors whatsoever. The only communication allowed is via service interface calls over the network.

4) It doesn’t matter what technology is used. HTTP, Corba, Pubsub, custom protocols – doesn’t matter.

5) All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions.

6) Anyone who doesn’t do this will be fired.— Jeff Bezos (emphasis mine)

This has two ramifications:

it increases the quality standards of internal tool development – development teams must create as if it’s for a customer

if an internal tool is really phenomenal and others can benefit from it, the company can externalize it and turn it into a revenue-generating product.

In this vein, Stitch Fix can look to externalize its capabilities.

With this customers get a seamless shopping experience that helps them find the clothes they love by their favorite brands wherever they want to shop.

Apparel companies get access to Stitch Fix’s advanced matching algorithm APIs. When a customer comes to an apparel company’s website and they log in, the company does not have enough information to make predictions on what the customer will like based on previous sales history, given that customer has likely only previously purchased a handful of items. With Stitch Fix’s recommendation algorithms rooted in granular customer data across several different brands, an apparel company can offer much stronger recommendations to customers based on a richer and more in-depth purchase satisfaction history.

In addition to matching customers with clothes that they will love, apparel companies can also benefit from an internally facing data & insights platform the provides precise customer feedback data on specific clothing to improve future product design. Currently, companies are effectively using sales data to inform design, which offers imprecise insights and slow feedback loops. Furthermore, the granular customer preferences can also help apparel companies forecast demand for products to manage production and inventory stock.

Lastly, Stitch Fix obtains a new recurring, high-margin SaaS revenue stream and more customer feedback data by expanding its reach through third-party channels – it can now help customers find what they love wherever and whenever clothes are bought on the entire internet.

It’s a win-win-win!

Some might wonder whether this cannibalizes Stitch Fix’s existing business. However, the guiding economics principles for apparel companies like Nike remain the same regardless of what Stitch Fix does:

An apparel company will recognize that D2C will always be more profitable when considering its GTM strategy; and

if a retailer has a unique way to reach consumers, it will continue to leverage the differentiation of that channel.

Should Stitch Fix not pursue an externalized SaaS offering, apparel companies will simply attempt to in-house the capability themselves, as Nike is seeking to do with its OneNike marketplace strategy.

“Our OneNike marketplace strategy leads with Nike Digital in our own stores and embraces a small number of strategic partners who share our vision to provide a consistent premium shopping experience. Connected data, inventory and membership will give consumers greater access to the best of Nike with more speed and convenience than ever.”

— John Donahoe, Nike CEO

Stitch Fix has an opportunity to capture value for apparel companies in that process.

Stitch Fix’s distribution channel will still hold value for apparel companies, namely those that don’t have the brand power to attract customers and scale to even think about building in-house data & analytics capabilities that the largest companies do.

Customers will continue to come to the Stitch Fix app to look for the clothes that they will love across brands, thanks to the relationship they have with Stitch Fix. Informing that experience with shopping that happens through Stitchfix.com will only make that channel relationship stronger.

Such a service will make Stitch Fix both a better channel and a stronger company.

Scoring

Strategic Importance: 5

Aligns with Stitch Fix's value proposition of uniquely helping people find items to wear that they will love

Drives increase in items kept by customers by meeting them in more places and provides an additional data stream

Hedges against Stitch Fix’s reliance on its own distribution channel's success, doubling down on data science as its competitive advantage

Increased brand exposure (i.e., “Intel Inside”- or “Pay with Affirm”- like branding

Business Value: 5

High-margin revenue source via recurring SaaS revenue and/or a take-rate off of influenced GMV

Capital efficient, offloading inventory risk

Complexity: 2

Requires strong software development capabilities

Based on a B2B business model, contrary to Stitch Fix’s B2C focus (i.e., navigating B2B sales cycles, etc.)

Requires integration with customer’s legacy systems

Cost: 3

Requires funding for software development

4. Rental Program

Value Category: Improve Share of Current Wallets & Access New Wallets

Value Lever: Increase Order Rate & Increase Market Penetration

Customer Opportunity Area: Help me expand & extend my wardrobe

Currently, Stitch Fix helps customers buy items that they love, but not all items make sense to purchase outright. However, clothes that people love and clothes that people will wear keep for a long time are not necessarily mutually inclusive. There are instances where a customer finds a piece of clothing that they love, but it doesn’t make sense to purchase.

A primary use case for this intersection is an occasion - e.g., going to a black-tie event or going on a vacation with a climate different from where you live. For events like these, you certainly want to be the best version of yourself, wearing clothes that you love, but it doesn’t make sense to break the bank to do so.

For these situations, the sharing economy is a perfect fit. The sharing economy creates value by increasing the usage of underutilized assets. The economics of owning a tuxedo can turn out to be quite expensive on a per-use basis – it spends a lot of time sitting on a hanger and is not very cheap! Instead of having the tuxedo collect dust, the sharing economy passes the item around as different people need it, renting the item when an occasion arises.

Stitch Fix is really well set up for this: (1) their distribution model being set up for returns simplifies incorporating a rental service (2) their high-trust commerce provides assurance that you are going to love the product – there is no need to spend a premium on a tailored item because Stitch Fix will find the perfect item for you.

Though Stitch Fix’s distribution model is set up for the high velocity of a rental program, other challenges will present themselves. Stitch Fix’s competitive advantage is providing high-trust commerce and a rental program provides a lot of opportunities to tarnish trust. Items can come back with tears, stains, or smells from previous holders, and if it isn’t resolved or removed from inventory, it can create a relationship-ruining experience. Ensuring this doesn’t happen can be costly.

Scoring

Strategic Importance: 3

Increases items kept by customers by meeting some of their more nuanced needs

Expands Stitch Fix’s ability to serve as a one-stop-shop for customers’ clothing needs

Business Value: 2

Increases access to wallets of customers by meeting some of their more nuanced needs – i.e., occasions, vacations, etc.

Complexity: 3

Requires building new competencies to manage a rental lifecycle (e.g., dry cleaning, stitching, etc.) from clothing wear and tear

Additional risk to tarnishing brand reputation from poor experiences

Cost: 4

Requires logistics and distribution center investments

5. Sunglasses & Eyewear

Value Category: Access New Wallets

Value Lever: Expand into New Product Categories

Customer Opportunity Area: Let Me Do More With You

For a retailer, there are two essential strategic choices to make:

Merchandise Strategy: Selling products customers want.

Go-To-Market Strategy: Reaching customers at the right place & time and in the right way.

As it pertains to merchandise strategy, Stitch Fix has many opportunities to expand its product category offerings. When evaluating potential product categories, it’s important to consider how the product category improves its ability to offer a unique experience to customers.

To this end, new Stitch Fix categories should meet two fundamental criteria:

data science can create a competitive advantage

offering the product is additive to the brand’s purpose of helping people find items to express themselves that they will love

One category that meets these two criteria is eyewear.

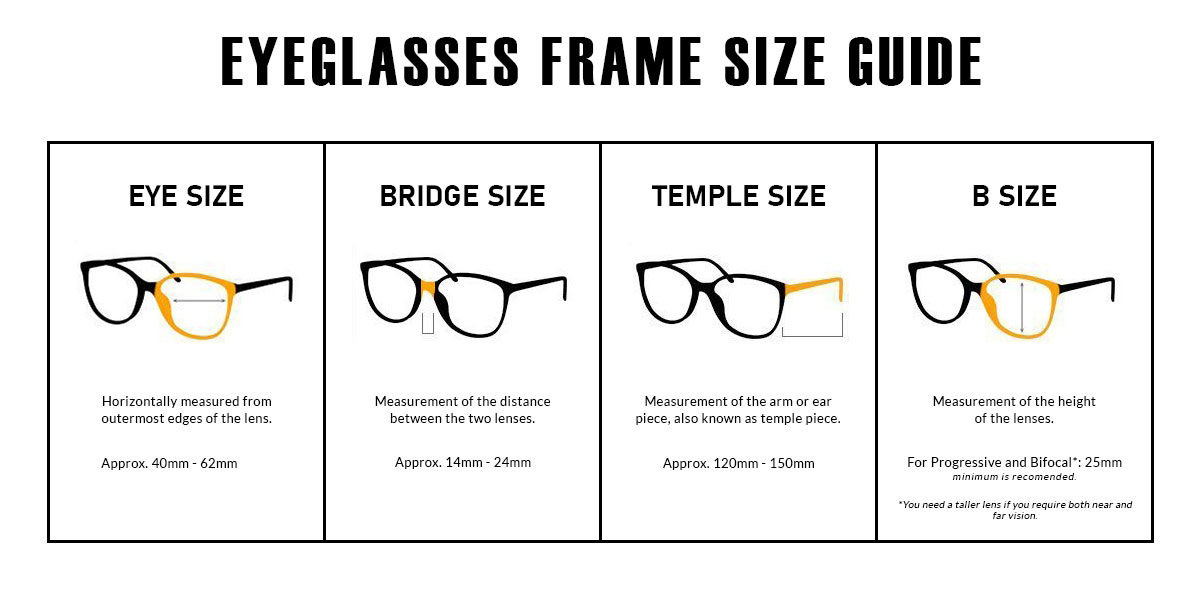

From a data science perspective, frame dimensions are both precisely quantifiable and important to the purchase decision – they matter significantly in determining preference. Stitch Fix can map the basics of a pair of glasses: eye size, bridge size, temple size, and B size to match them with sizes that work well for customers, in addition to other characteristics like color, material, etc.

Stitch Fix can even expand beyond the traditional measurements and fully map the curvature of the lens to have a true representation of the glasses’ size & shape.

On the other hand, eyewear also aligns perfectly with the brand’s purpose. Like with clothing, eyewear is an opportunity to express yourself and a great product can help you feel like the best version of yourself.

Eyewear, with its high gross margins, proposes an attractive profitability-accretive segment to Stitch Fix. Furthermore, they are much smaller and lighter than clothing, making distribution and reverse logistics more cost-effective than its clothing business given equal return rates.

Additionally, having another product category with detailed and granular customer data presents an opportunity to create new exclusive labels or extend current ones. As with the clothing personalization opportunity, this could lead to more personalized product design for customers as well.

Glasses also lend well to AR opportunities because of the fewer privacy concerns that come with facial scans vs. full-body scans. Eyewear offers an opportunity to leverage AR as a new way for customers to interact with products, trying them out before purchase. A successful implementation can reduce costs associated with returns and establish a high-trust relationship.

Lastly, some might wonder whether there is a place for Stitch Fix in eyewear where trendy companies like Warby Parker and Zenni also call home. While these companies are more established, they would not be direct competitors as Stitch Fix is a retailer. Warby Parker and Zenni produce their own sunglasses – you can’t buy Ray-Ban, Persol, or Gucci sunglasses on their sites – while Stitch Fix sells many brands. This can give Stitch Fix an advantage as their ultimate goal is to help consumers find products they love, regardless of who makes them.

Scoring

Strategic Importance: 4

Aligns with Stitch Fix's value proposition of uniquely helping people find items to wear that they will love

Data science is a source of competitive advantage

Drives increase in items kept by customers through a new SKU

Business Value: 4

Eyewear yields attractive gross margins

Eyewear’s smaller form-factor and lighter weights make distribution and reverse-logistics more cost-effective than clothing, given equal return rates

Complexity: 4

Requires launch of a new SKU from a cold start

Requires new manufacturer relationships

Requires building a new competency for exclusive labels

Cost: 4

Requires expanding inventory

Increase in selling & marketing expense

6. Beauty Products

Value Category: Access New Wallets

Value Lever: Expand into New Product Categories

Customer Opportunity Area: Let Me Do More With You

As noted in the eyewear opportunity, new Stitch Fix categories should meet two fundamental criteria:

data science can create a competitive advantage

offering the product is additive to the brand’s purpose of helping people find items to express themselves that they will love

Another category that meets these two criteria is cosmetics. There are quite a few items within cosmetics (e.g., skincare, makeup, fragrances, etc.), but since they exhibit many of the same characteristics, we will look at them collectively.

From a data science perspective, Stitch Fix has the opportunity to characterize products beyond the simple filters that traditional e-commerce experiences provide to offer more personalized product recommendations. For example with makeup, Stitch Fix can create a catalog of the precise color of makeup items to match them with nuanced customer preferences, or for skincare, Stitch Fix can leverage the ingredient list to help parse out which ingredients deliver results for individual customers.

Additionally, from a brand perspective, cosmetics fit into Stitch Fix’s purpose of helping people find things to express themselves that they love. Empowered by data science, stylist-equivalents can help customers by offering expert recommendations to cater to their unique needs, leaving customers looking to Stitch Fix to feel and be their very best.

Cosmetics appears to have the basic foundation for Stitch Fix to add more high-margin SKUs to its catalog and flex its muscles by testing the concept outside of its core competency.

However, there is a potential catch. Stitch Fix’s competitive advantage best helps with item discovery. Customers may look to re-purchase some products, which favors Wave 1 e-commerce companies that optimize for price and convenience. A successful outcome for Stitch Fix could lead to a purchase cycle where is at a competitive disadvantage, limiting potential. With clothing or eyewear, each new purchase tends to be unique, positioning Stitch Fix to be the best option time after time.

Scoring

Strategic Importance: 3

Aligns with Stitch Fix's value proposition of uniquely helping people find items to wear that they will love

Data science is a source of competitive advantage

Drives increase in items kept by customers through a new SKU

Stitch Fix is at a competitive disadvantage for non-discovery purchases

Business Value: 4

Beauty products yield attractive gross margins

Beauty products small form factor and weight makes distribution and reverse-logistics more cost-effective than clothing, given equal return rates

Complexity: 3

Requires launch of a new SKU from a cold start

Requires new data science competencies to expand beyond physical dimensions and styles to include nuanced beauty product characteristics

Requires new manufacturer relationships

Requires building a new competency for exclusive labels

Cost: 4

Requires expanding inventory

Increase in selling & marketing expense

7. International Expansion

Value Category: Access New Wallets

Value Lever: Expand into New Geographical Markets

Customer Opportunity Area: Let Me Do More With You

Entering new geographies is challenging and time-intensive to do successfully. The team will be faced with tackling a myriad of new challenges ranging from setting up a completely new value chain in the country to complying with a different set of laws and regulations. To maximize the odds of success, it’s crucial to minimize the number of variables that the team has to deal with.

Because entering a new market is a lot of work, the opportunity must be right-sized for the investment – from both an effort and capital perspective.

As such:

The market must offer a large enough reward to make the effort worth it.

The probability of successfully entering the market must be high enough to be able to seize the opportunity.

In other words, when evaluating potential opportunities for international expansion, you want to maximize your expected value:

As such, we need to come up with a set of conditions to evaluate international expansion candidates along with their form of measurement.

Using these conditions as a foundation, we score countries against each other to understand their relative attractiveness.

On first thought, China, from the market size opportunity, might look like a really compelling option given its already massive fashion industry + growth trajectory, but Stitch Fix would face such a challenge to successfully cope with catering to cultural differences, language differences, and government considerations – to name a few. This is reflected in our scoring rubric through its lower logistics and cultural similarity scores.

Based on these criteria, we get Germany, Canada, France, China, and Russia as the most promising expansion opportunities. Germany presents the most attractive opportunity given its large apparel market and strong e-commerce penetration, logistics index, and cultural similarity.

Scoring

Strategic Importance: 5 • Business Value: 4 // Complexity: 3 • Cost: 3

If you have any questions, thoughts, or would like to connect, please don’t hesitate to reach out via LinkedIn or Twitter!